The vast majority of funding from COVID supplementals, infrastructure funding, and the climate-focused portions of the Inflation Reduction Act, will pass through to states, localities, territories and Tribes. For new programs, particularly energy, transportation, and cybersecurity grant programs that may have required rulemaking, administrative setup, and staffing, the funding has taken some time to flow. With looming mid-terms elections, agencies are picking up the pace with a steady stream of announcements.

First, state plans for COVID funds from the American Rescue Plan Act (ARP) of 2021 have firmed up. States and localities have received— but not fully spent—$350 billion in funding from the State and Local Fiscal Recovery Fund (SLFRF) in the ARP. Additionally, over the summer, the $10 billion COVID Capital Projects Fund made four funding announcements; as of September 8, the awards total $1.4B, focused on broadband initiatives.

The SLFRF, while designed for health needs and economic recovery, can be used for almost anything at the state and local levels. It is the most flexible federal funding for states and localities that we have seen since 9/11. States and localities will chart their own course and decide on priorities for their own jurisdictions within the legal requirements. However, the administration encourages five types of uses for SLFRF and Treasury requires reporting of funding in these categories:

- Investments to replace lost public sector revenue

- Public health improvements

- Dealing with negative economic impacts of the pandemic

- Premium pay for essential workers

- Water, sewer, and broadband infrastructure improvements

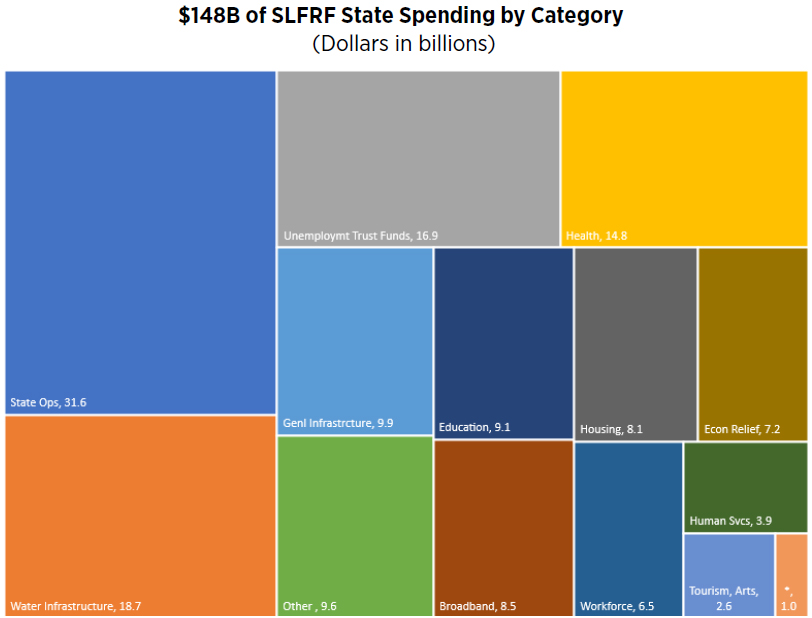

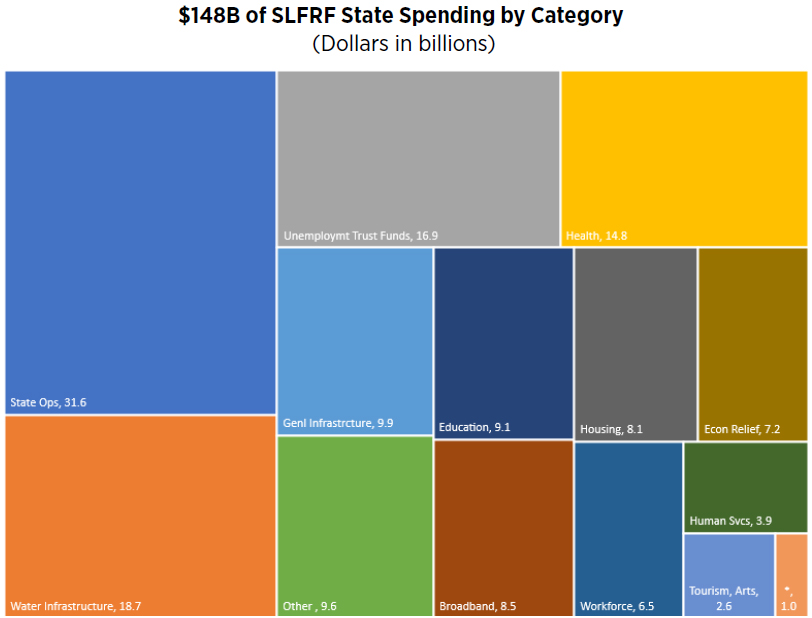

Spending plans were due to Treasury on July 31, 2022. While Treasury has not yet posted them, the National Conference of State Legislatures (NCSL) analyzed recent state data providing key insights on how state and local spending priorities have evolved. NCSL looked at the $200 billion provided to states and categorized the first $148 billion obligated or committed as of September 2, 2022. As shown in Chart I, nearly a quarter of the funds ($31.6B) were spent on state government and administrative costs, with water infrastructure ($18.7B), unemployment trust fund replenishment ($16.9B) and health costs ($14.8B) in second, third and fourth place. It is notable that just 24 states were responsible for the $16.9 billion to replenish unemployment trust funds; given improved employment conditions additional trust fund contributions are unlikely.

*Access to Justice, $960M Chart I: SLFRF State Spending by NCSL Category, Source: NCSL, Data as of 9/02/2022

As states contemplate the remaining $52 billion in SLFRF funding, most are doing so from an enviable fiscal position. The National Association of State Budget Officers (NASBO) reported on July 29 that “the strong growth in tax collections and revenues exceeding forecasts led many states to report their largest surplus in state history.” From these surpluses, governors are looking at many options including tax relief, reducing debt, or increasing emergency “rainy day” funds. The balance of SLFRF funding is on top of the reported surpluses, so we anticipate that many states and localities will look at new SLFRF spending decisions with an investment mentality and avoid decisions that create a funding cliff (such as pay raises that have follow-on costs).

Information technology investment is a great candidate for both governors and local officials—to fix existing systems infrastructure problems, build capacity, and manage future costs. Attractive investments include information technology to improve cybersecurity, build out services for citizens, improve data management and analysis, maintain infrastructure, and update internal systems to assure access, efficiency, transparency, and compliance. Treasury requires SLFRF funding to be obligated by 12/31/2024.

The spending picture for large cities and counties (over 250,000 population) differs slightly but we also expect their IT investments to expand in 2023. Large cities and counties received $62 billion of SLFRF funds and have obligated $25 billion. (Smaller entities received the remainder of SLFRF funds but limited reporting requirements for them excludes them from this analysis.) The National Association of Counties (NACo), National League of Cities (NLC), and Brookings partnered to track county and city spending. As of July 12, the group reports that $25.3 billion was obligated, with the majority of funds for government operations (42%); public health (14%), infrastructure (12%) and economic development and workforce (9%). A caveat: the data set used is as of 12/31/2021. At that time, large counties and cities still had funding decisions for the remaining $36.7 billion. However, as with states, we expect an investment mentality to factor in to remaining SLFRF spending decisions. To that point, the NACo, NLC and Brookings report predicts: “With many places having addressed acute needs with the first round of ARPA funds, cities and counties may now have the opportunity to consider more strategic, scaled strategies with their remaining flexible funds.”

As we build a better America, we’re ensuring that our infrastructure is more modern and digitally connected. But along the way, we must also take proactive steps to increase our resilience to the increasing threat of cyberattacks. Thanks to the President’s Bipartisan Infrastructure Law, we’re making a once-in-a-generation investment of $1 billion in infrastructure cybersecurity, giving our state and local governments the resources they need to guard against debilitating cyber threats.”

White House Infrastructure Coordinator Landrieu,

September 16

To kick off the $1 billion State and Local Cybersecurity Grant Program, the Department of Homeland Security announced Notice of Funding Opportunity (NOFO) (DHS-22-GPD-137-00-01) on September 16. Funding for the program is from the Infrastructure Investment and Jobs Act (IIJA), also called the Bipartisan Infrastructure Law. IIJA provided $1 billion over four years for funding to states and localities to assist them in securing their systems against cyber risk, strengthening the cybersecurity of their critical infrastructure, and ensuring resilience against persistent cyber threats.

Each state is guaranteed a minimum of $2 million with additional funds set by formula: the state allocation table included in the NOFO package indicates a range of $2.2 million (WY) to $8.5 million (TX). Puerto Rico will get $2.4M and territories are set to receive $500,000. Local governments are eligible sub-recipients through the states. According to DHS, a separate Tribal grant program will be announced in the fall. Two agencies within DHS are managing the process and providing guidance and oversight

— FEMA is administering the grants, while CISA is providing subject matter expertise, evaluating proposals and providing guidance on cybersecurity issues and approaches.

The first tranche of funding totals $185 million to be released to states by November 30. States have 60 days to apply for funding (deadline November 15) and are required: 1) to pass at least 80% of the funds on to localities (or provide items or services in lieu of funding if the locality agrees), and 2) distribute a minimum of 25% of the funds to rural areas. There is a 10% cost share requirement, but DHS has authority to waive it for economic hardship.

Key Cybersecurity Best Practices: To keep pace with today’s dynamic and increasingly sophisticated cyber threat environment, SLT governments must take decisive steps to modernize their approach to cybersecurity, adopting security best practices and advancing toward Zero Trust Architecture.

Excerpt from 9/16 NOFO,

DHS-22-137-000-01

The Department of Energy (DOE) is key for both IIJA (or the Bipartisan Infrastructure Law) and IRA. These laws have had, and will continue to have, a huge impact on DOE’s mission and have transformed DOE’s focus and organizational structure. DOE declares that “for the next five years, the Bipartisan Infrastructure Law will stand up 60 new DOE programs, including 16 demonstration and 32 deployment programs, and expands funding for 12 existing Research, Development, Demonstration, and Deployment (RDD&D) programs.” The Inflation Reduction Act also funds and sets up new climate resilience-related programs at DOE, the Environmental Protection Agency, and the Department of Agriculture.

The latest DOE announcement represents leadership for the national EV Charging Network program. On September 20, DOE and the Department of Transportation announced Gabe Klein as the Executive Director of the new Joint Office of Energy and Transportation. He will oversee the $7.5 billion initiative funded in IIJA to build a national electric vehicle (EV) charging network, and other vehicle electrification programs across DoT and DoE.

Other recent DoE announcements include:

- July 7- $18.3 million for Research to Develop Advanced Chemical Sciences Simulation and Modeling Capabilities

- 25- $540 million in awards for university- and National Laboratory-led research into clean energy technologies and low-carbon manufacturing

- 25- $400 Million for Research at Energy Frontier Research Centers

- Aug 25- $140 Million for Research on Chemical and Materials Sciences to Advance Clean Energy Technologies and Low- Carbon Manufacturing

- 26- $425 million in formula funding through the State Energy Program (SEP) to enable states to develop and implement a variety of clean energy programs, such as Installation of renewable energy systems and clean energy infrastructure

- 30- Request for Information (RFI) to get input on the $10.5 billion Grid Resilience and Innovation Partnership Program, designed to improve resilience and reliability of the country’s electric grid. The NOFO is expected in late 2022.

- 12- $21 Million to Support Energy-relevant Research in Underrepresented Regions

For a comprehensive list of the DoE-related rulemaking associated with IIJA, see DoE’s Bipartisan Infrastructure Law Program & Funding Opportunity Announcements.

President Biden signed the Inflation Reduction Act (IRA) just over five weeks ago, on August 16. Analyzing the effects of IRA’s direct spending and tax cuts will take some time, as will new program rollouts. One focus of the IRA is reducing greenhouse gas emissions by 40% by 2030, so climate and environmental programs are key. IRA also provides tax incentives to boost the development and deployment of clean energy. Separately, it includes healthcare legislation and various tax changes. An initial resource is the White House-developed IRA state fact sheets, highlighting IRA from the state perspective.

Significant new IRA programs include:

- $3B for a new EPA grants program for state and local entities, the Port Pollution The program will fund activities related to purchasing or installing zero-emission port equipment or technology and supporting activities.

- $2.6B for Coastal Conservation funding to the National Oceanic and Atmospheric Administration (NOAA) to award grants and other financial assistance to state and local governments for conservation and restoration of coastal and marine habitats and resources.

- $760 million for Transmission Facility Siting (DoE grants to Siting authorities).

- $3B for Environmental Justice Block Grants, administered by EPA, to carry out projects that benefit disadvantaged

While we have focused on new programs here, there is also acceleration in funding releases for existing programs that received additional funds from either IIJA or the IRA.

FBIQ recommends assisting state and local partners by tracking programs of interest, NOFOs, NOIs and other administrative processes, and federal requirements for funding to your jurisdiction, lab, educational institution, utility, nonprofit, or company. With seven weeks before the consequential mid-term elections, the pace of program rollouts will increase. Funding to implement policy changes in SLFRF, IIJA and IRA give the Biden Administration and state and local leaders plenty of runway in every Congressional district and state.