Today, success requires strategies that anticipate emerging trends, identify opportunities, and manage risk.

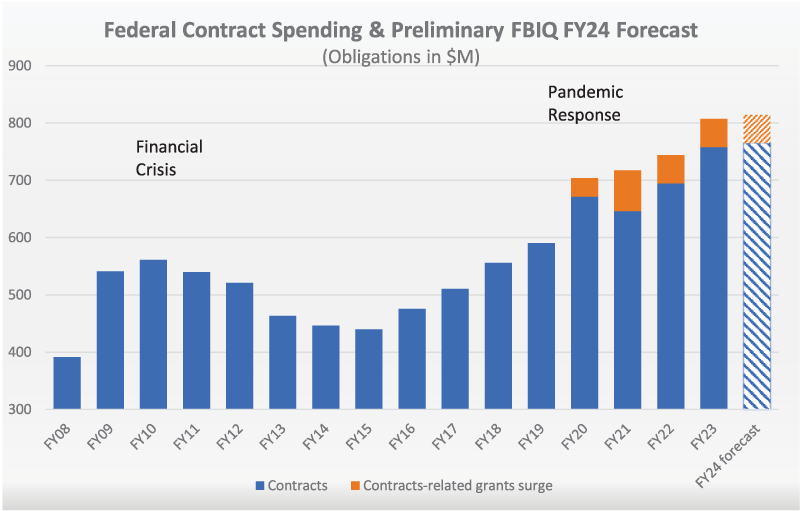

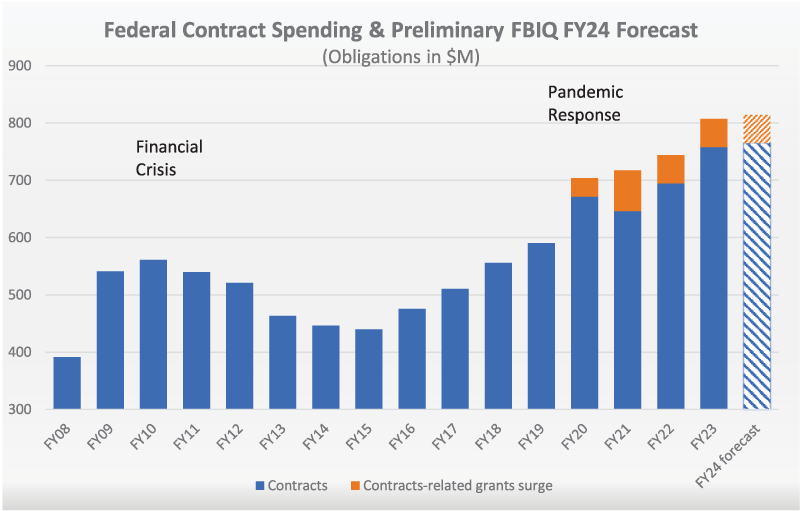

In January 2024, Federal Budget IQ (FBIQ) adjusted our 18-month forecast to reflect enactment of major legislation by the 117th Congress that increased FY22-FY31 spending by almost $2 trillion outside the appropriations process.

- The 10-year $1.2 trillion Infrastructure Investment and Jobs Act (IIJA), P.L. 117-58.

- The Honoring our PACT Act, P.L. 117-168, included over $450 billion in expanded VA benefit and operating costs and billions in non-defense discretionary baseline adjustments; and

- The Inflation Reduction Act, P.L. 117-169 included over $250 billion in funding for clean, green energy programs (and set discretionary caps for FY24-25).

The IIJA and the Inflation Reduction Act increased federal spending (both mandatory and discretionary) primarily through grants. This funding spike for activities traditionally financed through appropriations alters agency and Congressional spending priorities. The bottom line—despite constraints on regular FY24-FY25 appropriations, FBIQ expects FY24 federal contract spending to increase slightly.

Understand the difference between what government documents say and what they mean.

FBIQ market assessments consider:

- Emerging Administration and Congressional Funding Priorities

- The Federal Policymaking Process

- Practical Operational Issues that May Alter Implementation Prospects and Timetables

- Budgetary, Economic, and Political Conditions

- Feedback from Government Insiders

- New Opportunities

Understand the difference between what government documents say and what they mean.

Federal Budget IQ’s Monthly Newsletter

Each month Federal Budget IQ produces a forward-looking executive level report with analysis and forecasts on issues and actions impacting public sector operations, spending patterns and priorities. Subscribe to evaluate the quality of our work.

Initial Demonstration Project

A demonstration project allows you to control costs and evaluate a deliverable to determine whether Federal Budget IQ’s customized market intelligence work is the right fit for you. Most clients start with a 30-45 day public sector market assessment demonstration project. Options range from a broad sector-focused market outlook for defense, federal civilian agencies, or state and local government to a deep-dive analysis on a strategic market priority.

Annual Partnership (Standard, Enhanced, Concierge)

Once we earn your confidence, the next logical step is a customized annual partnership. Pick from three categories that allow you to customize and scale our work on a pace and budget that makes sense for you.

Standard

Twelve-months of the Federal Budget IQ newsletter, quarterly check-ins with David Taylor, two-three sector-focused market outlook briefings for defense, federal civilian executive branch agencies, and/or state and local government.

Enhanced

Twelve-months of the Federal Budget IQ newsletter, quarterly check-ins with David Taylor, Friday Notes–a quick recap of key events in the style of memos produced for Congressional leaders and White House senior staff, two-three sector-focused market outlook briefings for defense, civilian agencies, and/or state and local government, up to three deep-dive briefings on client-selected strategic market priorities.

Concierge

Twelve-months of the Federal Budget IQ newsletter, quarterly check-ins with David Taylor, Friday Notes–a quick recap of the week’s events in the style of memos produced for Congressional leaders and White House senior staff, quarterly public sector market outlook briefings with sector break-outs for defense, civilian agencies, and/or state and local government, six customized client-selected deep-dive briefings including at least two half-day interactive tactical account-planning workshops on public sector market opportunities.

Strategic Partnership

Annual partnerships can evolve into a strategic partnership after an initial 6-12 month engagement. The initial period allows you to evaluate our team and develop a customized program integrating FBIQ’s work into your business processes, helping you and your executive team set and manage public sector market expectations, identify opportunities, adapt to changing market conditions, manage risk, and ultimately, focus business development and capture resources to boost sales. Strategic partners rely on real-time FBIQ updates and analysis on government actions and other events with addressable public sector market implications. Regular FBIQ deep-dive briefings and account-planning workshops help strategic partners validate, extend, and expand their public sector business development pipelines and improve alignment to emerging public sector growth opportunities.

Ready to Get Started?

Contact Us