November 01, 2021

White House Report Details Climate Risk to the Economy

On October 14, the White House released a new report on climate change and the need for resilience — “Climate Change Financial Risk: A Roadmap for Safeguarding the U.S. Economy.” The new report builds on Executive Order 14030, “Climate-Related Financial Risk” (May 20), and Executive Order 14008, “Tackling the Climate Crisis at Home and Abroad” (January 27) to focus on a whole-of-government effort to assess and mitigate climate risk.

“[T]he Federal Government’s assessments of fiscal and macroeconomic risks have yet to incorporate the physical and transition risks of climate change. In short, the current suite of data, tools, disclosures, and mitigation strategies fail to help investors, policymakers, and the public understand and make decisions grounded in the economic realities of the climate crisis.

National Economic Council Director Deese and National Climate Advisor McCarthy, October 14

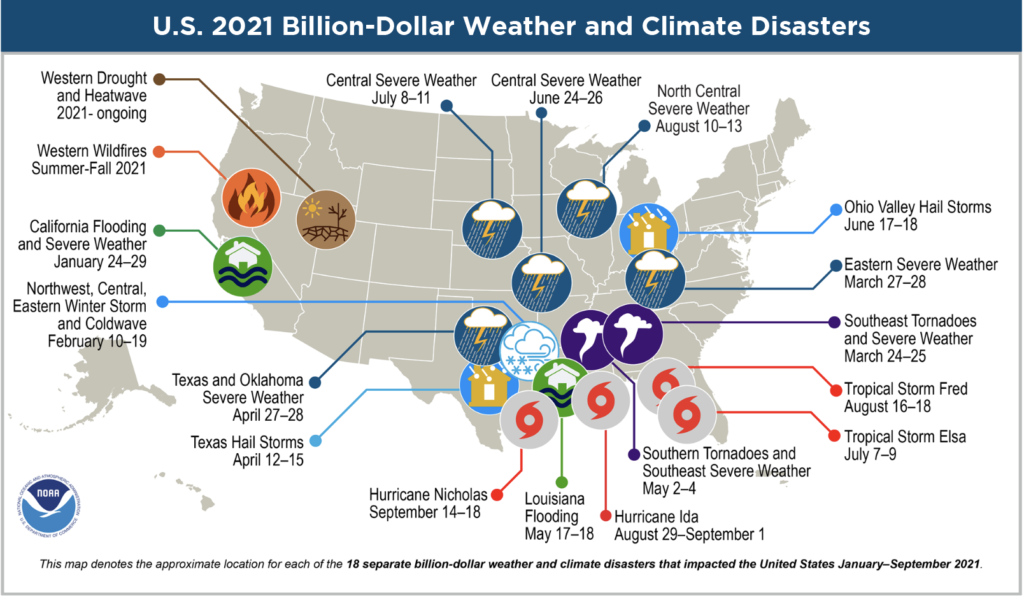

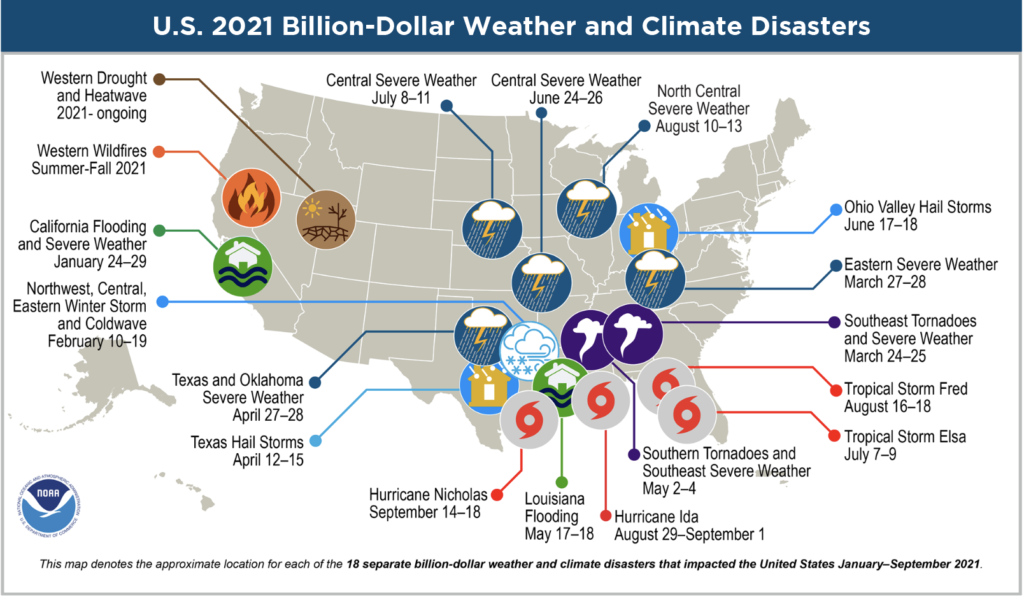

The White House report refers to a National Oceanic and Atmospheric (NOAA) finding that “Climate-related disasters from extreme weather cost an additional $600 billion in physical and economic damages over the last five years,” leading to reduced economic productivity including disruptions to commercial operations and supply chains. The White House identifies five “climate risk accountability framework principles:”

- Mobilizing public and private finance to support the transition to a net-zero emissions U.S. economy

- Protecting climate-vulnerable and disadvantaged frontline communities

- Protecting against financial risk to the federal government and the communities it serves

- Safeguarding the U.S. financial system against climate-related financial risk

- Demonstrating global leadership

Chart I. Source: NOAA.

Under the framework, this report describes an Executive Branch strategy and roadmap involving six action areas:

Promoting the resilience of the U.S. financial system to climate-related financial risks

The focus of this action area is financial regulation, including the ability of regulators to assess climate risk and the requirements for regulated entities to disclose risk. The report anticipates that regulators will develop analytical tools to enhance climate risk assessment capacity. The importance of data is also mentioned, with the report noting: “a more robust data environment — around physical impacts, transition risks, and greenhouse gas emissions… — can enable companies, financial institutions, and Federal Government leaders to drive urgent and necessary action to mitigate these risks.”

Using federal procurement to address climate-related financial risk

The Federal Acquisition Regulation (FAR) Council is considering two changes to procurement regulations that will have a direct impact on contractor requirements and federal agency decision-making. One change is to require major federal contractors to disclose greenhouse gas (GHG) emissions and climate-related financial risk and to set GHG reduction targets. In June, the FAR Acquisition Environmental and Contract Management team was tasked to draft a proposed rule.

The second change requires agencies to minimize climate change risk for major procurements by considering the social cost of GHG emissions in their contract decisions. A preference could be given to contractors with lower GHG emissions. An advance notice of proposed rulemaking appeared in the Federal Register on October 15.

Incorporating climate-related financial risk into federal financial management and budgeting

The Biden Administration wants to reduce the federal government’s exposure to climate change by increasing transparency in budget and financial reporting. The FY23 Biden budget will include an assessment of the government’s climate risk exposure and related effects on the budget outlook. Agencies will increase integration of climate risk into core business practices and will develop “more specific and actionable information” to include in future budgets. Climate data collection and analysis capabilities will play an important part in providing this budget information.

Building resilient infrastructure and communities

The White House’s National Climate Task Force (NCTF) established several interagency working groups to examine how to boost climate resilience against floods, wildfires, drought, storms, and other extreme events. As part of this effort, two reports on climate information and services have been delivered recently to NCTF. First, the National Oceanic and Atmospheric Administration, the Federal Emergency Management Agency, and the Office of Science and Technology Policy prepared “Opportunities for Expanding and Improving Climate Information and Services to the Public.” This report describes how agencies and partners will 1) develop science-based information and products, 2) develop tools and delivery mechanisms for climate services, 3) spur innovation, and 4) implement ambitious science and technology initiatives.

The second is a report by the Federal Geographic Data Committee (FGDC), a consortium of 29 federal departments and independent agencies, on “Advancing the Nation’s Geospatial Capabilities To Promote Federal, State, Local, and Tribal Climate Planning and Resilience.” The report discusses GeoPlatform (a shared services platform under FGDC) and other tools that can potentially improve accessibility and usability of climate data. FGDC recommends an evaluation of FGDC’s operational activities, which could lead to expanded federal mapping services and access to geospatial data.

The White House Roadmap report also notes that the President’s Build Back Better Agenda includes significant funding for investments to strengthen climate resiliency. The Build Back Better (BBB) framework Biden announced October 28 includes $555 billion for clean energy and climate investments, according to a White House fact sheet.

Protecting life savings and pensions from climate-related financial risk

Primarily through the Department of Labor, the government is taking steps to revise and adopt regulations that make it easier to incorporate climate risks and opportunities into decision-making by public and private retirement plan fiduciaries.

Incorporating climate-related financial risk into federal lending and underwriting

Federal agencies that administer lending programs, in particular the Departments of Housing and Urban Development, Veterans Affairs, and Agriculture, are incorporating climate risk into their underwriting standards, loan terms, asset management, and loan servicing processes. To coordinate these activities between agencies, the administration established a Climate-Related Financial Risk Task Force under the Federal Credit Policy Council.

Federal Agency Climate Action Plans

The White House report also mentions agency climate action plans in the context of procurement policy and infrastructure protection. Climate action plans, also known as adaptation and resilience plans, are required under Executive Order 14008, and Executive Order 14030 requires agencies to address climate-related financial risk. To date, 26 agencies have submitted climate adaptation and resilience plans to the sustainability.gov website. Chart II displays those agencies and includes links to each plan.

Chart II. Source: Sustainability.gov/adaptation/

To illustrate the information provided by these plans, the Department of Homeland Security (DHS) identifies five priority actions:

- Incorporate Climate Adaptation Planning and Processes into Homeland Security Mission Areas

- Ensure Climate Resilient Facilities and Infrastructure

- Incorporate Climate Adaptation into National Preparedness and Community Grants and Projects

- Ensure Climate-ready Services and Supplies

- Increase Climate Literacy

Diving further into “Ensure Climate Resilient Facilities and Infrastructure,” DHS highlights information and communications technology (ICT) as a key element of critical infrastructure resilience and sustainability. With the agency operating 7,989 facilities and leasing 4,065 buildings (as of August 2021), securing ICT from climate risk across all areas will be an immense challenge. DHS views energy security as essential to ICT climate resilience and plans an assessment of critical ICT assets, streamlined standards for secure Energy Management Control Systems, and targeted locations for distributed energy resources.

Climate resilience will continue to be a key Biden Administration policy and funding priority. Implementation at the agency operational level will largely depend on final climate-related funding decisions on Build Back Better and regular FY22 appropriations.

While FBIQ expects increased spending in these areas, BBB negotiations offer evidence that legislation enacted this year will fall short of the ambitious funding levels and policy changes originally advocated by the Biden Administration and progressives in Congress. The Clean Energy Performance Program (rewarding electricity suppliers that use clean energy and penalizing those that do not) is a case study. This program is absent from the October 28 BBB framework due to opposition from Sen. Manchin (D-WV). Manchin, whose vote is critical in the 50-50 Senate, will continue to influence proposed climate policy.