November 20, 2018

FBIQ’S Post-Election Market Outlook

An excerpt from a longer article in November’s Federal Budget IQ report

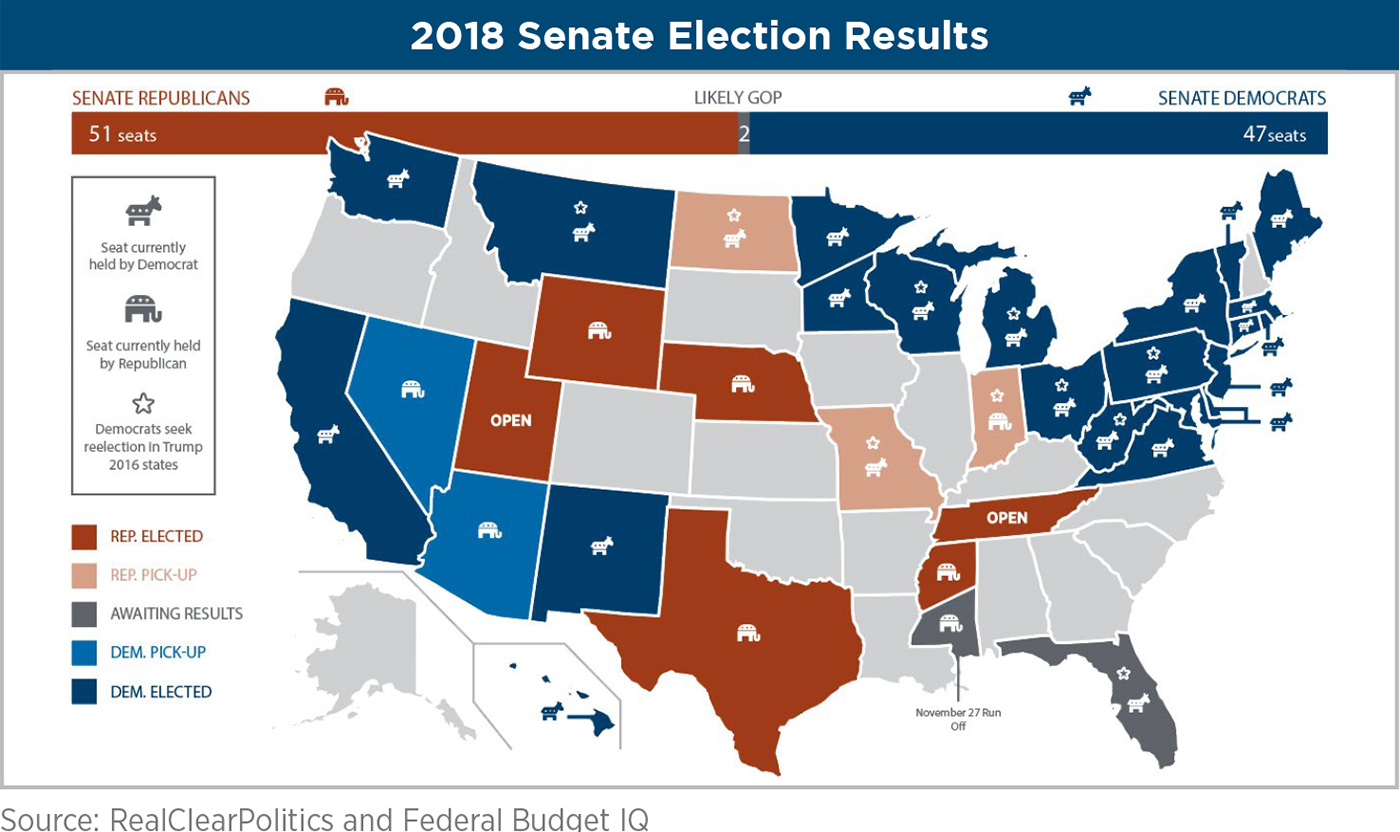

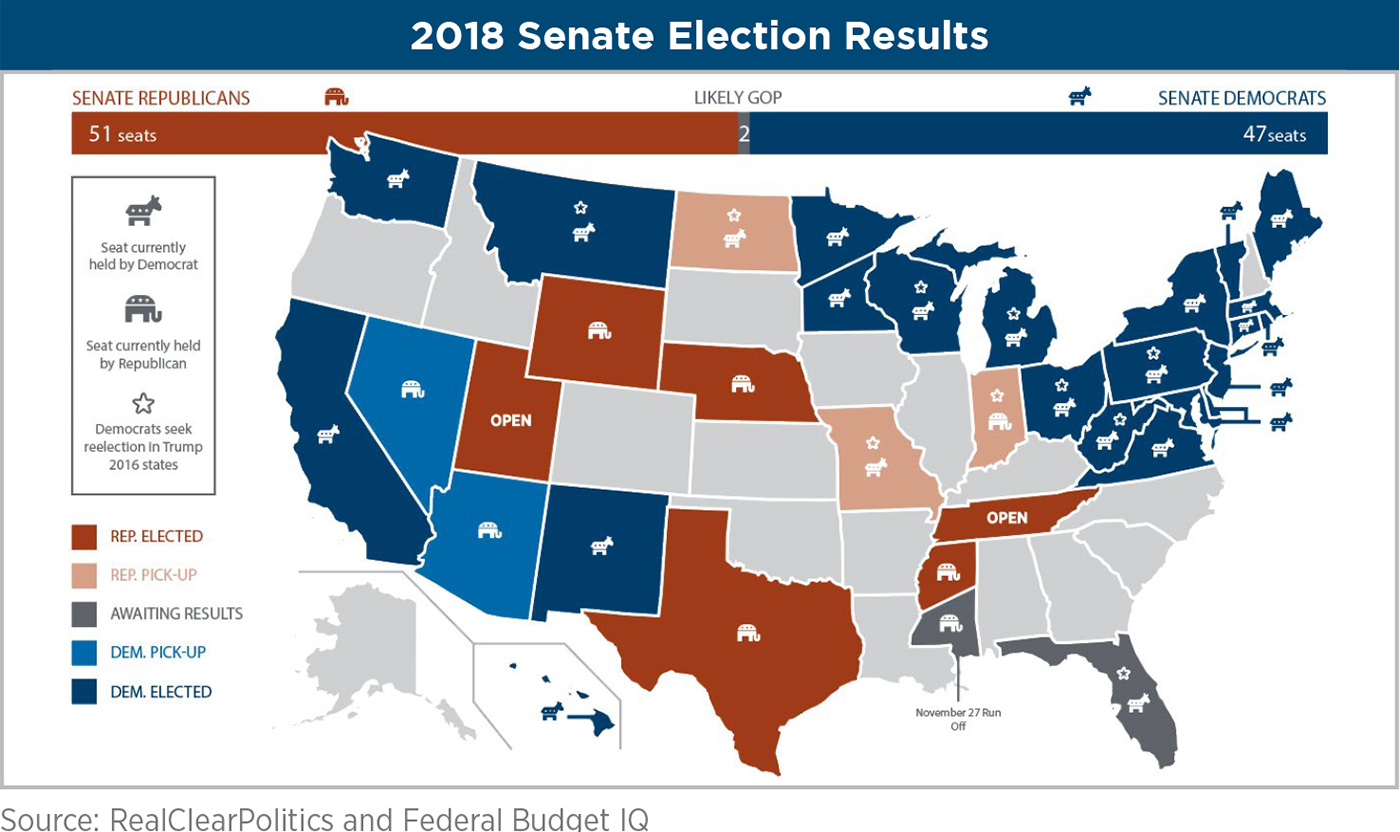

Even though five House races remain too close to call and one Senate race (the November 27th run-off for the Special election in Mississippi) have not been finalized, the results of the 2018 elections are clear. Voters put a big constitutional check on a President Trump and a Republican-controlled federal government by giving Democrats control of the House. They also gave newly-elected Democrats and Republicans little incentive to compromise on budget and policy matters.

For federal agencies, what’s the practical operational impact of the election results? More funding and policy and uncertainty for the next 12 months.

Every federal agency began FY18 operating under Continuing Resolutions (CRs) until legislation implementing a bipartisan budget agreement passed in March 2018 that provided each agency a larger-than-planned annual budget. Until those decisions were made, agencies were limited by CR restrictions and OMB guidance that depressed procurement spending before it spiked in the fourth quarter (Q4) of FY18. President Trump’s plan to cut civilian agency spending to offset defense spending increases made that first-half slowdown worse and the Q4 spike larger for civilian agencies.

FY19 will be different. First, as we reported in September, more agencies began FY19 with funding for the year decided than any time since 1997. For them, not having to worry about CRs or shutdowns means that, relative to FY18, procurement spending through Q3 should be significantly higher while Q4 spending declines.

Second, Congress has already completed most of the work needed to finalize funding for a $154 billion minibus appropriations package that includes Agriculture, Interior-Environment, Financial Services, and Transportation-Housing and Urban Development (T-HUD). Although additional short-term CRs are likely before this work is completed, at least three of those bills (political issues may derail Financial Services) should be finalized during the 115th Congress. For agencies whose FY19 funding is finalized by early January, procurement spending will be suppressed through Q1 before peaking in Q2 and Q3.

Forecast

75% FY19 Agriculture, Interior and T-HUD Appropriations are finalized before January 2019

Third, three appropriations bills Commerce-Justice-Science (CJS), Homeland Security, and State-Foreign Operations (and potentially a fourth—Financial Services) remain. Although staff reports that progress has been made on CJS, the elections increased the intensity of Census and Mueller investigation politics and the risk that funding for these agencies may not be finalized before March.

The Department of Homeland Security (DHS) finds itself in the eye of a political storm. At the same time FEMA is focused on the aftermath of Hurricanes Florence and Michael and record-setting California fires, President Trump has ordered troops to the southern border, repeatedly threatened a government shutdown over his border wall funding initiative, and reportedly plans to oust DHS Secretary Nielsen. That combination makes DHS our top December shutdown target at 65 percent. In the end, we expect a substantial increase in border wall funding to be approved. In the interim, a partial government shutdown will be more disruptive for contractors than for the affected agencies they serve.

At the Department of Justice (DOJ), Attorney General Sessions’ forced resignation, outrage from Democrats over Trump’s selection of Acting Attorney General Whitaker, Mueller investigation politics, and a long list of potential investigations by House Democrats complicate DOJ funding decisions and potentially them until spring. Even though Secretary of State Pompeo has more influence over President Trump than any other cabinet member, funding for the State Department and USAID is far from resolved and may ultimately be decided in a long-term CR.

Because Trump budget policy—particularly for the State Department and USAID—remains the limiting factor on agency spending until FY19 funding is finalized, FY19 procurement spending should be suppressed through the first half of the year before peaking in Q3.

As long-time Appropriations Committee members, both Senate Majority Leader McConnell (R-KY) and House Democratic Leader (and the frontrunner for Speaker in the 116th Congress) Pelosi (D-CA) want to wrap-up as much of the FY19 appropriations process as possible and “clear the deck” for their Congressional agendas. On the other hand, House Republican Leader-elect McCarthy (R-CA) is likely to back Trump’s border wall shutdown strategy. Discussions with House and Senate Committee staff suggest that House Democrats will push more forcefully on the Census citizenship question and other issues in the year-end discussions.

The good news is that partial government shutdowns are more likely to be measured in hours than weeks with most of the remaining bills resolved by year-end. The bad news is that some agencies may be funded for the remainder of FY19 in a long-term CR that includes anomalies for mission-critical activities like the Census and planned NOAA satellite launches and targeted political priorities.

Fourth, unless President Trump and a divided Congress agree to change the Budget Control Act and boost spending caps, federal agencies face a budget cliff in FY20 and increased shutdown prospects in FY20 Q1.

The core objective for federal managers facing budgetary uncertainty like CRs, shutdowns and sequesters is protecting agency headcount. Actions taken by Congress and the Department of Defense (DoD) to mitigate the impact of the FY13 sequester illustrate this point. By law, sequestration is an indiscriminate across-the-board reduction. In practice, sequestration works differently. Before the FY13 sequester, Deputy Defense Secretary Carter warned that sequestration would cause 22 furlough days for DoD civilian workers. A week later, Congress passed a DoD Appropriations bill granting DoD unprecedented transfer authority. When that bill was enacted, Carter announced that the number of furlough days dropped to 11. Afterwards, OMB and Congress approved a record-setting DoD reprogramming request that raided DoD’s procurement and investment accounts and drained its Working Capital Fund to protect agency headcount. Approval of that request dropped the number of furlough days to 6. Civilian agencies took similar steps albeit on a smaller scale.

With a divided Congress, precedent suggests that a bipartisan FY20 spending deal is unlikely to emerge before November 2019. Under those circumstances, procurement spending should slow in FY19 Q4 as agencies seek to park cash and give themselves increased flexibility to manage the operational impact of October budget declines.

In our December 2011 forecast, we argued that a 2013 sequester would happen and that implementation would differ from the law and disproportionately impact RDT&E and procurement accounts. That’s precisely what occurred. We came to that conclusion because President Obama and a Republican Congress were unlikely to agree on the budgetary offsets needed to eliminate the sequester and because the economic and political risks associated with simply turning off sequester – higher interest rates, US debt downgrades, etc., — were greater than the likely fallout from a $68 billion sequester.

Based on our analysis, FY20 looks a lot more like FY13 than FY18. Under FBIQ’s forecast, Congress and the President will reduce but not eliminate the looming FY20 Budget Control Act sequester with a 2-year budget agreement finalized by the end of next year that boosts both defense and non-defense spending caps. Even with that deal, a shortage of budget offsets with bipartisan, bicameral support make it likely that FY20 agency budgets fall short of FY19.

Forecast

80% Base Defense and Civilian agency budgets decline in FY20