On March 9, the President submitted the summary volume of his proposed FY24 budget, over a month past the statutory deadline. In addition to putting forward his priorities, the President took aim at Republicans the day his budget was released.

THE BIDEN BUDGET

Unlike his first two budgets, the President’s FY24 Budget emphasizes $2.9 trillion in deficit reduction over 10 years. The President achieves this with $4.7 trillion in increased revenues to offset $1.8 trillion in net new spending. Biden’s plan immediately drew scorn from the House Republican leadership.

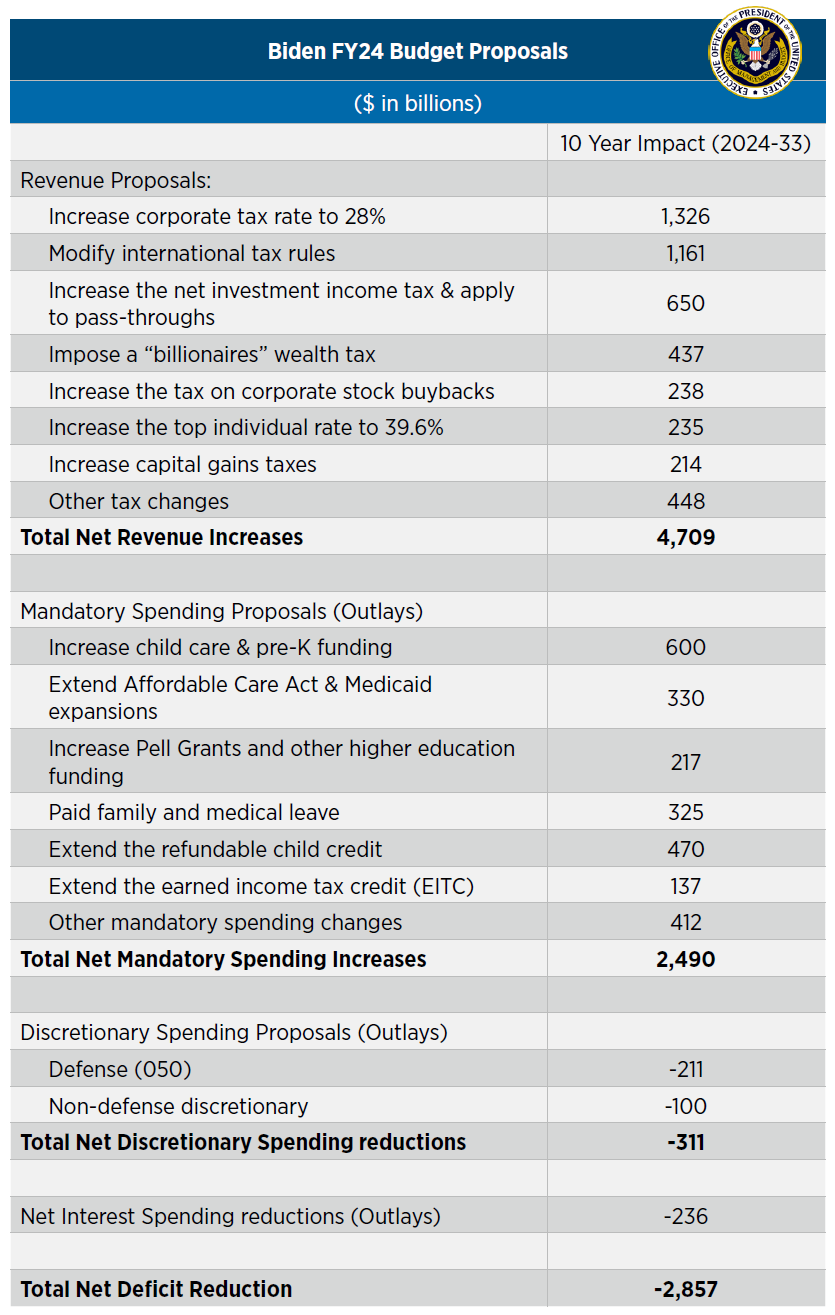

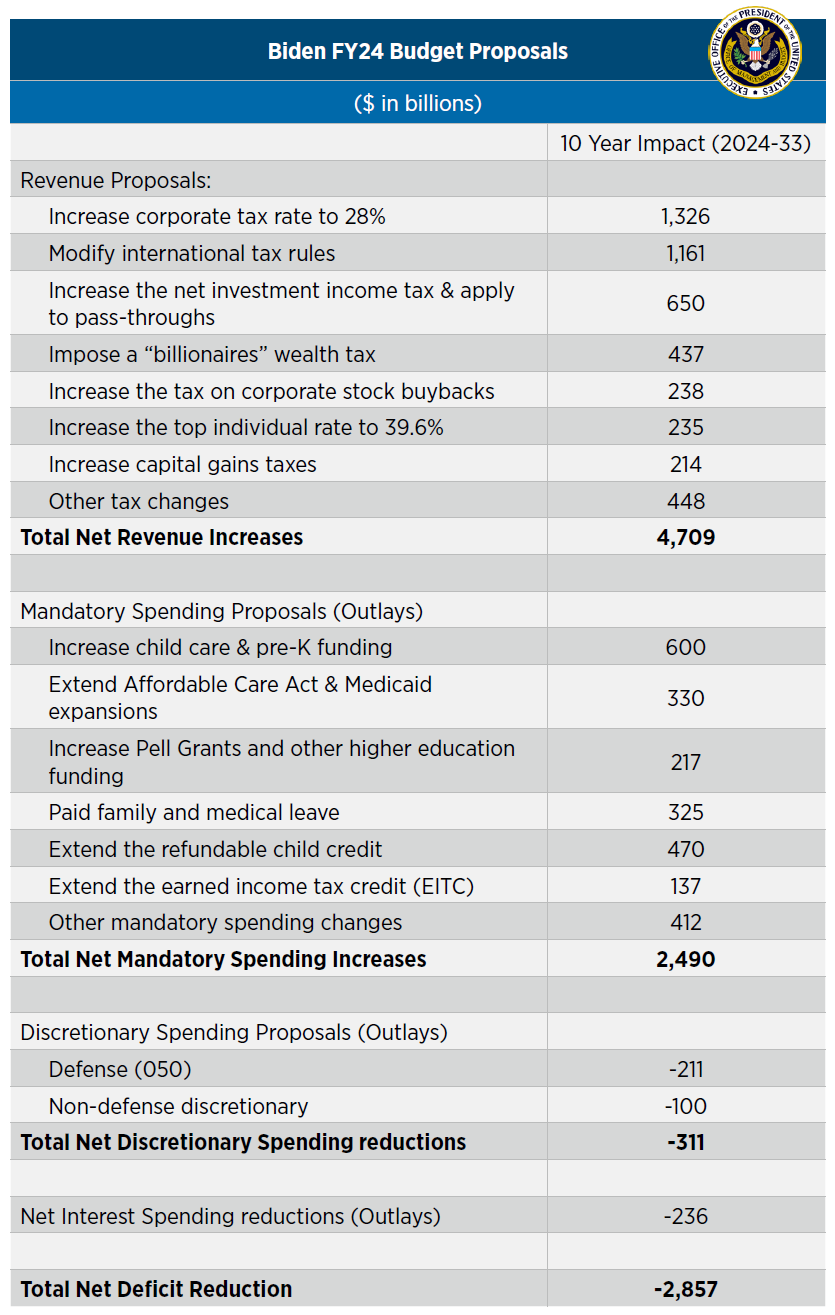

Budget proposals are divided into the three major categories—revenues, mandatory spending, and discretionary spending. Chart I outlines the 10-year budget impact of the Biden’s major spending and revenue proposals.

Chart I. Source: FBIQ, President’s FY24 Budget Summary Tables.

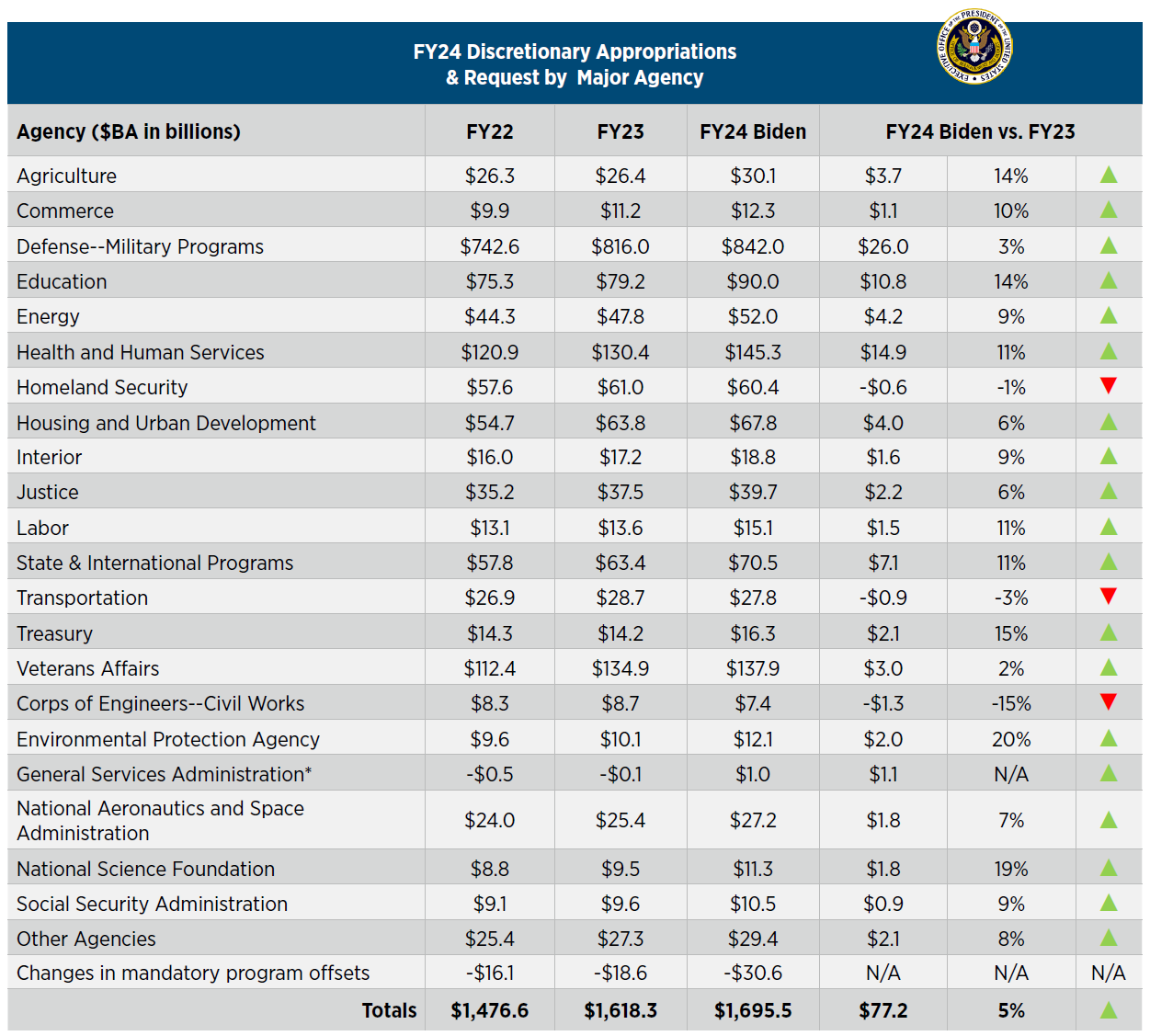

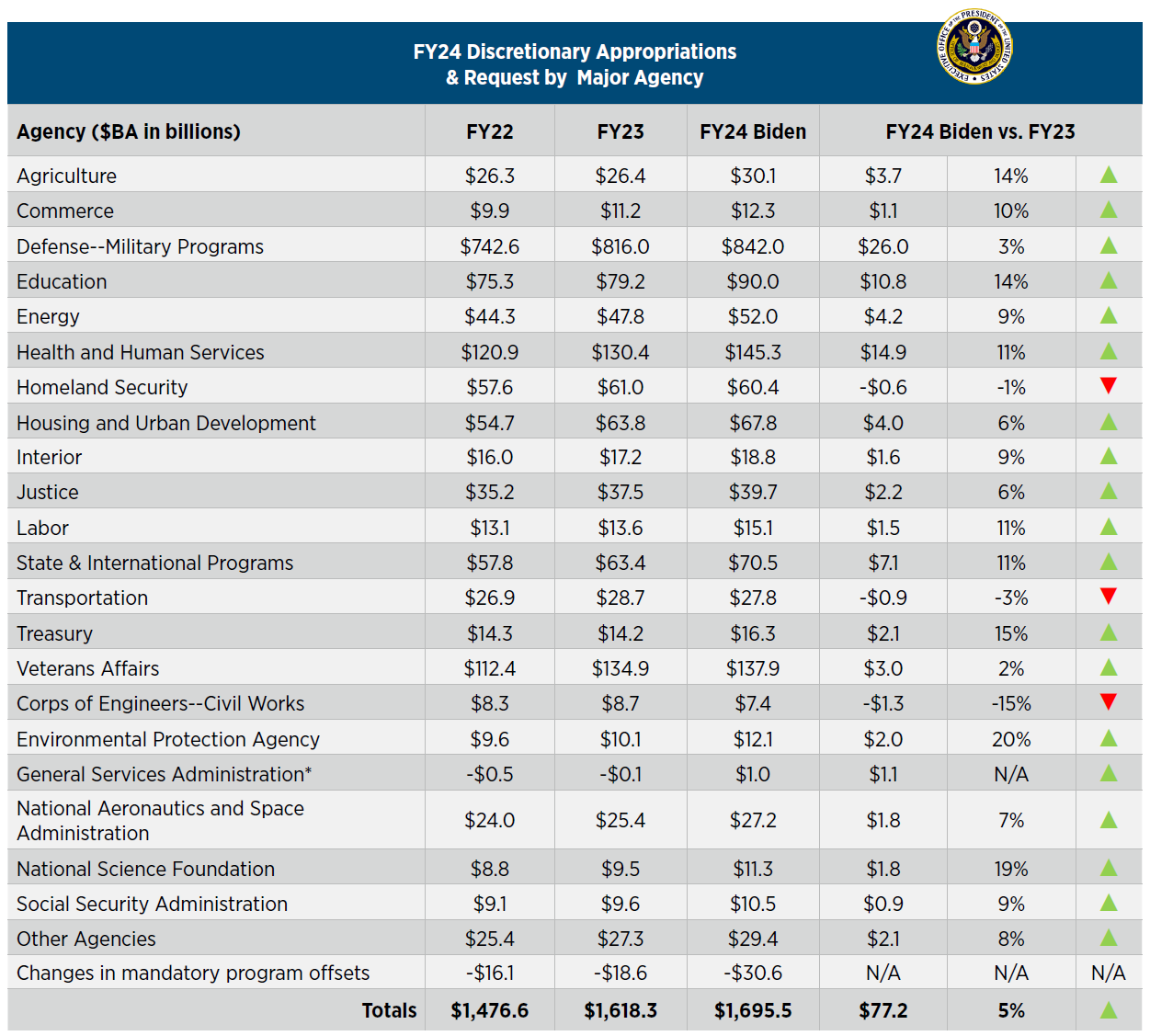

Since discretionary spending is enacted annually in appropriations bills, the post-FY24 out-year numbers are less relevant because they are revisited each year in the budget and appropriations process. For agency details in Biden’s FY24 Budget, see Chart II on page 4. If, however, the President and Congress pursue a budget agreement, it is likely to set total levels of discretionary spending for two years, probably broken down between defense and non-defense.

President Joe Biden’s budget is a reckless proposal doubling down on the same Far Left spending policies that have led to record inflation and our current debt crisis.

House Republican Leadership Statement,

March 9

In stark contrast to the President, we do not expect the House Republican budget to increase taxes. Instead, it will propose spending cuts and go well beyond the deficit reduction in the President’s budget, aiming to balance the budget by 2033. While Biden’s budget increases discretionary spending, House Republicans appear to be committed to reducing total appropriations to FY 2022 levels. That change represents a $130 billion spending reduction.

Chart II. Source: OMB, FBIQ. *GSA totals include offsetting collections (e.g., rent for federal buildings). Totals may not add due to rounding.

It’s no surprise that both the President and House Republicans are positioning for the upcoming budget negotiations with budgets designed to appeal to their respective bases. While both President Biden and Speaker McCarthy (R-CA) have traded partisan barbs over the budget, they both also have expressed a desire to resolve their differences to get things done. In his March 9th speech on his proposed budget, the President attacked “Maga Republicans” but also noted that one of the major reasons he ran for the Presidency was to unify the country and reiterated that he was ready and willing to meet with the Speaker to see if they could resolve their differences. McCarthy has taken a similar stance. He’s been highly critical of Biden’s FY24 Budget but reiterated his desire to meet with him to work out their differences.

The next step in this process is for the Congressional Budget Office (CBO) to produce its re-estimate of the President’s budget proposals. The House Budget Committee is in the process of developing an FY24 budget that will showcase stark differences with President Biden and the challenges the President and the Speaker must overcome to reach a bipartisan agreement.

We must commit to finding common ground on a responsible debt limit increase. Finding compromise is exactly how governing in America is supposed to work – and exactly what the American people voted for just three months ago.

Speaker McCarthy (R-CA),

February 6

Despite the focus on the big tax increases in the Biden budget or the big cuts in discretionary spending being considered by House Republicans, there is some common ground. The fine print of the Biden budget includes extensions of savings proposals that have been included in past bipartisan agreements regarding spectrum auction authority, a small mandatory sequester, and Customs user fees. Combined, those three proposals would produce over $100 billion in deficit reduction over 10 years. Small amounts compared to the challenge, but possible building blocks toward a bipartisan budget agreement.

Given the scope of the challenge and the late start to the process, precedent suggests a budget agreement is unlikely to emerge before mid-November. Before then, President Biden and Speaker McCarthy will face mounting pressure to approve a debt limit extension (likely before the August recess) and a Continuing Resolution (CR) to avoid a partial government shutdown beginning October 1.