April seems the proper time to review Internal Revenue Service (IRS) funding levels, personnel and technology investments, and service and performance. IRS received a large influx of new funding in 2022, initially focused on taxpayer services and improved technology. On Capitol Hill this week, IRS Commissioner Werfel touted the resulting performance gains for the 2023 and 2024 tax seasons. The Commissioner cited some stats in his April 16 written testimony to the Senate Finance Committee: taxpayers are now successfully getting help through the toll-free line 87% of the time, up from 15% in 2022; call wait times are 3 minutes down from 28 minutes in 2022; and IRS is increasing both self-service options and the locations and hours of in-person centers to meet different taypayers’ needs.

A well-funded IRS is like night and day for taxpayers. With the help of more funding and added resources, service for taxpayers this filing season eclipsed levels seen during the past decade. This tax season meant real-world improvements for people looking for help, whether calling, visiting in-person or using IRS.gov.

IRS Commissioner Werfel,

April 15

The Biden Administration IRS priorities in FY25 are: digitalization, fairness in enforcement, live assistance, clear notifications to taxpayers and stopping tax scams, self-service and online options, employee tools and experience, foundational technology, and human capital. Technology underpins many of these priorities. For example, IRS uses AI to look for compliance issues with large companies. Werfel testified that “compliance work includes focusing on delinquency and non-filing among high-income individuals, as well as leveraging artificial intelligence (AI) and hiring subject matter experts to find tax evasion among our largest and most complex partnerships and corporations.”

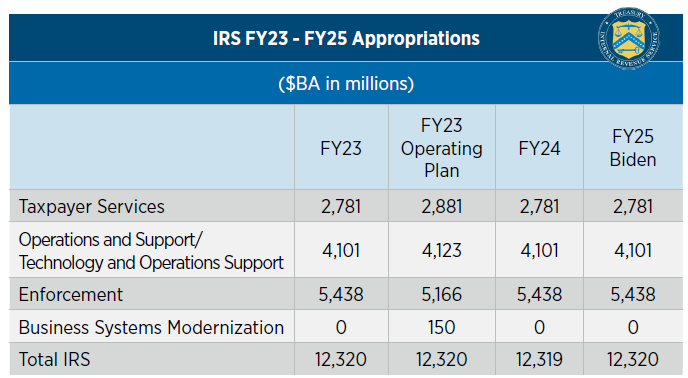

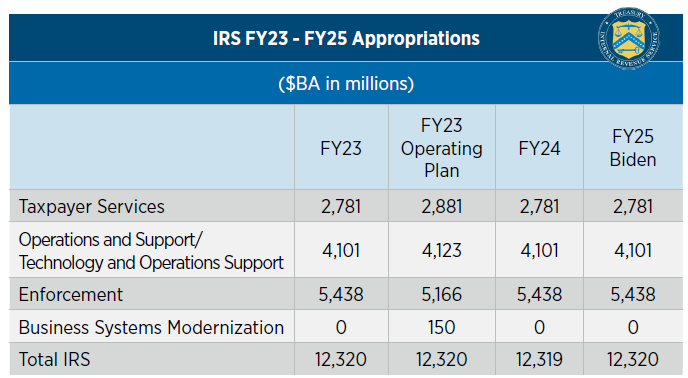

IRS FUNDING IN TWO ACTS

Appropriations for IRS became more political over the last dozen years, but funding disagreements reached a new level of controversy after the passage of the Inflation Reduction Act (IRA) in 2022, which provided $79.8 billion for IRS over ten years. While many investments, staffing, and policy changes have happened at IRS, its appropriated funding levels have been flat. Chart I shows IRS funds of $12.3 billion, by account, for FY23, FY24, and in President Biden’s FY25 Budget. The flat funding is essentially a “current services” budget. To accommodate mandatory pay raises and other required cost increases, IRS plans to use attrition to save $320 million that had been slated to cover 1,748 positions.

*FY25 budget proposes to rename the “Operations and Support” account to “Technology and Operations Support”. Chart I: IRS Appropriations Budget Authority (BA) FY23-FY25. Source: IRS FY25 Program Summary, FY24 appropriations.

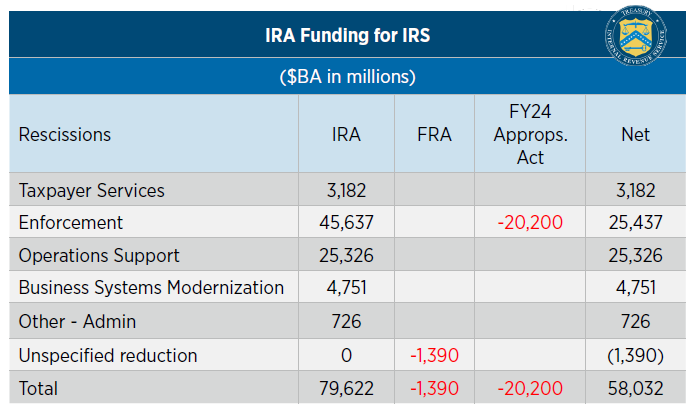

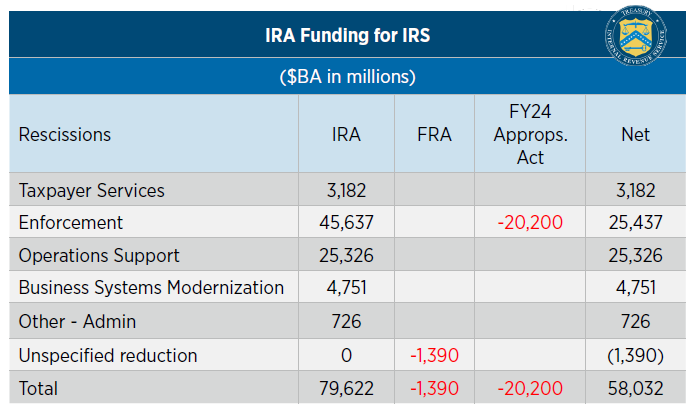

The IRA provided a second, massive funding stream for IRS, to transform the agency and to invest in people, processes and technology at IRS over a decade. The funding, in specified amounts for Taxpayer Services, Enforcement, Operations Support, Business System Modernization, and other smaller pots, was provided in addition to appropriated “base” funds. However, the IRA legislation was supported only by Democrats. No Republicans voted for the IRA and the IRA-provided IRS funds have become a particular target for cuts from the onset. IRS funds were trimmed by $1.4 billion in the debt-suspension bill, the Fiscal Responsibility Act (FRA), which also set spending limits for FY24 and FY25. Speaker Johnson (R-LA) attempted to pay for aid to Israel through a rescission of IRS funds within six days of being elected Speaker in October 2023. Most recently, to close the deal on FY24 appropriations, $20.2 billion was rescinded from the IRA IRS funding. As seen in Chart II, IRA funding has been decreased by a total of $21.6 billion. Nearly all of the rescinded funds were from the Enforcement account, which impacts projected revenue collections. The Congressional Budget Office (CBO) analysis of the FY24 appropriations act and noted that $20.2 billion in IRS rescissions would reduce projected revenue by “$1.3 billion in 2024, $17.6 billion over the 2024-2028 period, and $38.0 billion over the 2024-2033 period.”

Chart II: IRS Funding from IRA and Rescissions To Date. Source: IRA, FRA, P.L. 118-47.

Even with this huge funding influx, almost five times the IRS annual amount, the IRS wants more. The IRS budget states that by FY26, the IRA resources for Taxpayer Services will be “entirely consumed.” President Biden’s FY25 Budget includes a mandatory funding proposal for $104 billion to cover ten years of additional IRS technical investments, systems and staffing rebuild; the IRS Commissioner says the investment “will pay for itself several times over, yielding an estimated $341 billion in revenue.” While this proposal has no chance of being adopted in 2024, we expect it to resurface in future budget deliberations as a way to increase revenues without raising taxes.

TECHNOLOGY: BUY AND BUILD

IRS plans outline detailed IT areas that the agency is most heavily investing in, where unspent funds sit, and where it is putting money into development. In a Senate Finance Committee hearing on April 16, Commissioner Werfel was pressed on IRS’ “buy or build” policy, and asked about his guiding principle for in-house development versus seeking COTS products, especially when commercial solutions may be ready to go with slight or no modifications. Commissioner Werfel replied that he agreed that “off-the-shelf is the way to go, and that in general government agencies tend to try to customize when they shouldn’t.” Instead, he opined, “you should modify your business process to meet the commercial off-the-shelf solutions.” Werfel concluded “It’s a better approach. We can certainly be more aggressive in that space.”

IT UNDERPINS IRS

Every IRS plan—strategic, operating plans, and capital investment—shows how heavily IRS relies on IT investments. The IRS mission and IT are inextricably linked: IT is how IRS reaches taxpayers, and how taxpayers and preparers contact IRS and submit questions, forms and information. IT is how IRS communicates, analyzes, screens, audits, and assures security of private and sensitive information.

IRS delivered an Inflation Reduction Act Strategic Operating Plan for FY23-FY31 to Congress in April 2023 to lay out a roadmap for the transformation that the $79 billion in funding would bring to the agency. While over $20 billion of the total funds have been rescinded since then, the plan remains a useful to see IRS’ big-scale transformation strategies with IT specifics, objectives and initiatives, key projects and milestones, and detailed measures of success planned over ten years. Objective 4, “Deliver cutting-edge technology, data, and analytics to operate more effectively” includes IRS plans to retire legacy applications and adopt modern systems, modernize IT Infrastructure, use data and analytics to drive operations and decision-making, and ensure security of systems and privacy of taxpayer data.

For FY25 specific IT investment information, the Department of the Treasury posted the IRS FY25 Capital Investment Plan (CIP), which includes major IT and major non- IT investments planned for FY24 and FY25. The projected CIP IT total for FY25 is $5.3 billion, a $1.9 billion or 57% increase over the $3.4 billion in FY23 actual spend, and a $131 million, (+3%) increase over FY24 levels. Note that only investments defined as “major” are included, so the list is not comprehensive. The largest increases over FY24 on a percentage basis are for Case Management (+26%), Compliance (+20%), Network Services (+13%), and Tax Account Management (+14%). Digital Services decreased 36%.

IRS PLANNED FY25 IT SPEND HIGHLIGHTS

- Case Management ($486 million), including automated workload allocation, control proper permissions and requirements, configuration of workflows with continuous feedback, decommission legacy systems, upgrade servers to expand capability for digitally handling correspondence

- Compliance ($312 million), refine pilots “for large corporate enforcement, high-income and high wealth enforcement, and in key segments,” develop new detection and enforcement analyses, continue foundational infrastructure updates

- Compute ($429 million). Refreshed mainframes in FY23 and in FY24 and FY25 plan to transition to cloud and managed service providers, mitigate security risks by conducting continuous monitoring and hardware and software patches

- Digital Services ($375 million), Expand Digital Service offerings across multiple service channels, add more self-service options, add capabilities like online business filing, new digital communications capabilities, and account profile customizations

- Filing and Intake ($594 million), convert non-digital submissions (i.e., paper, fax, and image files) into machine-readable formats for efficient use and processing, projects include onboarding compliance functions to a digital platform that will enable scanning, extraction, and downstream routing capabilities for the Form 9465, delivering over 25 Robotic Process Automations, and expanding historical document digitalization to clear up to 1 billion priority documents

- Network Services ($607 million), include refresh VoIP Call Manager infrastructure and internet protocol across VoIP, upgrade and expand network to accommodate the larger workforce and increased consumption patterns due to digitalization

- Platforms and Applications ($192 million), focus areas are Robotics Process Automation, the Enterprise Data Platform and Advanced Analytics In FY25, IRS plans to develop new analytics-enabled capabilities to support digital asset compliance, make near- real-time taxpayer service data available to IRS data scientists and analysts via modern analytical tools

- Tax Account Management ($663 million) to modernize the IRS’s core tax processing systems, retire aging legacy systems, and enhance account management capacities, establish data distribution services to streamline access to taxpayer accounts, begin updating the programming languages in legacy master files

- User Services ($590 million) provides end user focused IT products and services for all IRS employees, provide hotel workstations for employees working in office, transition to ServiceNow Information Technology Asset Management System, interface for fully automated interactions and responses to provide technical support

- Infrastructure Management ($485 million), improve to support taxpayer-facing operations, upgrade critical infrastructure to maintain filing season systems resiliency, leveraging cloud-based infrastructure where practical

- Engagement Channels ($139 million), authenticate and deploy Voicebots or Live chats for multiple functions, Taxpayer Assistance Center Contact Modernization

WHAT’S AHEAD

With the IRA funds in hand, IRS is still turbo-charged—despite a flat FY25 base budget (at best) and a Biden request for new FY25 mandatory funding that will not be approved. The IRS Commissioner knows that the faster he can implement fixes that improve taxpayer services, modernize IRS systems, improve the ways in which taxpayers and preparers engage with the agency, simplify forms and guidance, and maybe use AI to unearth some large-scale tax cheats, the more secure his IRA funds will be. Early reports are that the 2024 tax filing season went smoothly, and the metrics look good—but maybe everyone is still distracted by women’s college basketball. Either way, the IRS needs to show results, and in the IT realm, the agency will not benefit by spending a lot of time developing exquisite, customized solutions that won’t roll out until tax filing season FY29. That time pressure, plus Congressional interest for IRS to be more receptive to private sector off-the-shelf solutions, could mean a sunny forecast for IRS IT opportunities in FY24 and through FY25.