September 25, 2023

IRS FY24 Budget, Tech, and Enforcement Priorities

The Internal Revenue Service (IRS) is tasked with collecting revenue to fund federal government agencies and programs and enforcing taxpayer compliance with federal tax laws. IRS processed 260 million returns and collected $4.9 trillion in taxes in FY22, with a workforce of 72,648 FTEs. The agency’s main roles are collecting individual and corporate taxes, examination of returns, providing taxpayer assistance and administering refunds and tax credits. The IRS budget aligns with its functions: Taxpayer Services; Enforcement; Operations and Support; and Business Systems Modernization. IRS receives annual appropriated funds and has long advocated for system improvements and other technical modernization needs that cannot be met with the level of appropriations provided. Congress has constrained regular IRS funding for the last 15 years: the Congressional Research Service reported in April 2023 that, between FY10 and FY19, the IRS budget (measured in 2021 dollars) declined 20.4%, and over that time IRS cut enforcement agents by 40% and decreased audits.

“SEA CHANGE” AT IRS

Like previous administrations, the Biden Administration budget asked for investments to modernize systems and close the “tax gap”—the difference between taxes owed and taxes paid. IRS Commissioner Wurfel stated Sept. 8, “There is a sea change taking place at the IRS in every aspect of our operations…the IRS is deploying new resources towards cutting-edge technology to improve our visibility on where the wealthy shield their income and focus staff attention on the areas of greatest abuse.” In an October 2022 report, the Treasury estimated the 2014-2016 tax gap to be $496 billion, and projected it to increase to $540 billion for 2017-2019. The Biden FY24 budget is particularly focused on:

- Closing the tax gap for the wealthy;

- Providing accessible taxpayer services by phone and in person;

- Increasing audit rates; analyzing high income and large corporate and large partnership tax returns, aided by information technology that supports enforcement; and

- Deploying digital tools for communication with taxpayers.

ANNUAL FUNDING

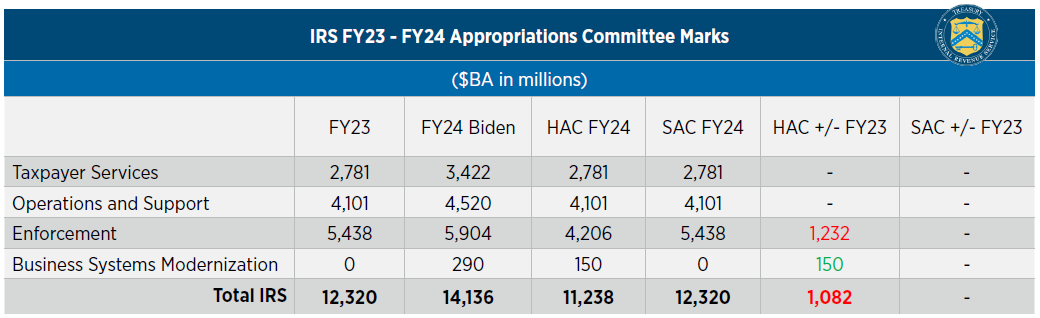

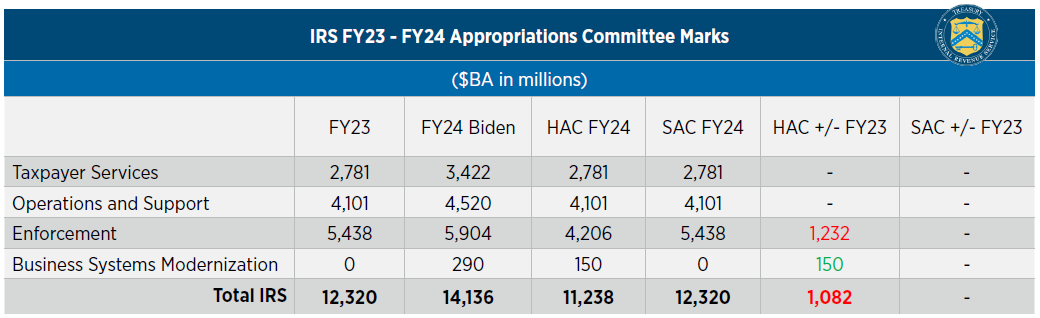

IRS annual appropriations were $12.3 billion for FY23, with Enforcement accounting for the majority of the resources (44%), followed by Operations and Support (33%), and Taxpayer Services (23%). The Biden Administration requested

$14.1 billion for IRS in FY24, a 15% increase, as seen in Chart I. Congress has not supported the increase. The Senate Appropriations Committee (SAC) held the IRS to its FY23 level for all functions in its markup on July 13. It should be noted that the spending caps in the Fiscal Responsibility Act (FRA) signed into law in June are slightly lower than enacted FY23 levels for civilian programs. The SAC is marking its bills to the cap levels. On the same day, the House Appropriations Committee (HAC) held their markup and kept Taxpayer Services and Operations and Support at FY23 levels, but cut funding for Enforcement by 23% (or $1.2 billion) from the current level. This is part of an historical pattern of reductions when Republicans control the House. Unlike the SAC, the HAC is marking up its bills at about $119 billion below the caps. The HAC provides $150 million for Business Systems Modernization (BSM), a little more than half of the $290 million for BSM requested in the Biden budget. SAC provided no funding for BSM.

Chart I. Source: IRS FY24 Budget, HAC, SAC, Congressional Research Service

TEN-YEAR “TRANSFORMATION” FUNDING

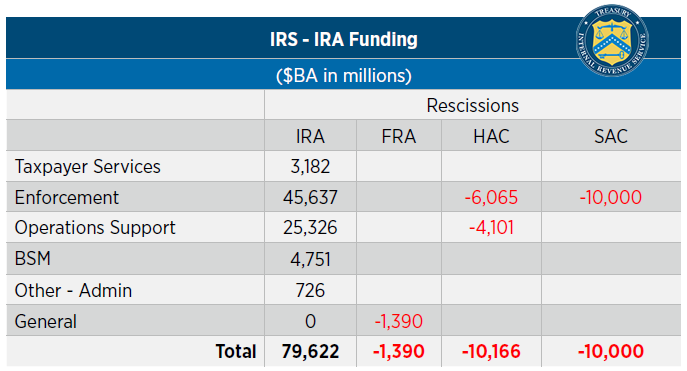

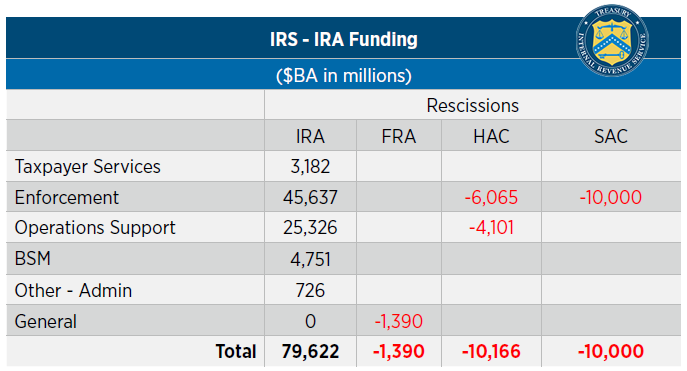

Last year, the IRS was provided with a massive infusion of resources focused on transformation, $79.6 billion over ten years, as part of the Inflation Reduction Act (IRA) of 2022. The IRA directed the long-term funds be spent to update and modernize technology capabilities, enforce tax laws (including hiring more enforcement agents), and to provide new tools, skills and capabilities for IRS employees to serve the public nationwide. The funding was provided to supplement the IRS’s annual funds in order to invest in revamping and modernizing both the administration of the tax system and the customer service experience. In April 2023 IRS unveiled a Strategic Operating Plan for the IRA funding.

The operating plan addresses many aspects of IRS modernization in detail. Highlights on the tech and operations side include: IRS is accelerating and expanding technology modernization throughout the agency; replacing IT systems with a full enterprise approach; retiring legacy systems; and using analytics, AI and the expertise of data scientists to improve compliance and identify tax evasion.

Just ask a lottery winner—with any large funding windfall, there come challenges. In June, negotiators for the debt limit suspension deal agreed to cut IRS IRA funding by $1.4 billion, and the rescission was enacted as part of the FRA, as shown in Chart II. Reports (covered by FBIQ) that an additional side agreement was made by the negotiators to rescind up to $10 billion from the IRS IRA funds for FY24 and FY25 appropriations proved accurate: both the HAC and the SAC clawed back IRA funds as part of their FY24 Committee-approved bills. The HAC rescinded close to $10.2 billion: nearly $6.1 billion from Enforcement and $4.1 billion from Operations Support. SAC rescinded $10 billion from IRS Enforcement.

Chart II. Source: IRA, FRA, HAC, SAC

Despite these cuts, IRS plans to spend $2.8 billion of the IRA funds in FY23, hiring 10,000 people, and plans to use $5.8 billion in FY24, hiring 19,500 more. The agency issued a 1-year “report card” on its IRA investments on August 16. Highlights of the stats for filing season 2023 include: IRS answered 3 million more calls and cut phone wait times to three minutes from 28 minutes, served 140,000 more taxpayers in person, digitized 80 times more returns than in 2022, and fully cleared the backlog of unprocessed 2022 individual tax returns. The report also highlights technology priorities to be addressed with the funding.

To enable improved taxpayer services and compliance, we must deliver technology capabilities at a faster pace and bigger scale than we have achieved before. We will invest in new technology, building on contemporary foundational platforms, with modern architectures designed to meet our future needs…

While ensuring the continued privacy and security of taxpayer data, we will enhance our use of data and analytics to drive operations and decision-making.

IRS Strategic Operating Plan, April 2023

MACHINE LEARNING AND AI HELP ENFORCEMENT

On September 8, the IRS announced significant expansion of its high-income/high wealth and partnership compliance work. IRS intends to magnify its abilities to root out non-compliance through targeted application of Artificial Intelligence (AI). Specifically, IRS said it is expanding a pilot compliance program focused on large partnerships (which on average hold $10 million in assets). IRS states, “With the help of AI, the selection of these returns is the result of groundbreaking collaboration among experts in data science and tax enforcement, who have been working side-by-side to apply cutting-edge machine learning technology to identify potential compliance risk…. in a taxpayer segment that historically has been subject to limited examination coverage.”

OUTLOOK

The top-line FRA appropriations cap for non-defense agencies that was made law in June means that the best-case scenario for most agencies in FY24, including IRS, is a flat-line budget. The FY24 Biden budget submitted to Congress in March was based on higher levels of spending that pre-dated FRA, and is not attainable. SAC marked to the FRA top-line caps, customizing each subcommittee’s specific funding to meet Senate priorities. However, the House marked to lower levels than the cap, at approximately FY22 spending levels, necessitating sizable cuts to current services for most non-defense agencies. For IRS, the FY24 HAC mark is $1.1 billion, or 9%, below FY23 funding, while the SAC is the same as FY23. The HAC and SAC included rescissions to the IRS IRA 10-year funds, with the Senate cutting $10 billion from Enforcement and the House $10.2 billion from Enforcement and Operations.

In final FY24 action, the rescission from IRA will likely settle at $10 billion and the FY24 appropriated funding level could land between a zero increase (same as the FY23 level) and a 2%-3% decrease. However, the long-term outlook for IRS tech investments, including modernization and platforms that can support and enable analytics, machine learning and AI, is more rosy. Technology is how IRS will address the tax gap, find non-filers, under-reporting, and under-payment. Technology is also how IRS will get information to people who want to be in compliance to file quickly and easily. IRS reports the current voluntary compliance rate to be 85.1%, and estimates that for every one percent increase in the compliance rate, it can collect $40 billion in owed taxes. The ten-year IRA funds and the carryover funds that IRS can access give the agency funding flexibility to continue IRS technology modernization and transformation, even in a fiscally challenging and politically charged environment.