The 117th Congress was one of the most productive in recent memory. The $1.9 trillion American Rescue Plan Act provided resources to distribute vaccines, fund health care for millions of COVID-19 patients, shore up state and local government budgets, provide billions in stimulus for key sectors of the economy, and expand the social safety net for workers. That and rapid development of effective vaccines sparked a dramatic economic rebound in the U.S. in the second half of 2021. Last November, President Biden signed the 10-year $1.2 trillion Infrastructure Investment and Jobs Act (IIJA). Then after extensive negotiations, Congress approved the $52.7 billion CHIPS & Science Act (CHIPS), the Inflation Reduction Act which funds $118.5 billion in expanded health benefits and $138.2 billion in clean, green energy programs through FY26, and the Honoring Our Pact Act (Pact Act) which expands veterans benefits for 23 presumptive conditions, increasing VA benefit and operating costs by an estimated $63.7 billion over five years (FY22-6).

Each of these bills provide fiscal stimulus to an economy grappling with high inflation, international supply chain disruptions, Russia’s invasion of Ukraine, global food shortages particularly in Africa, and increased prospects for a recession in the EU and other key markets. Their adoption complicates the Federal Reserve’s effort to control inflation making it harder for Federal Reserve Chairman Powell to navigate a “soft landing.”

Let’s put ARPA aside. That emergency spending bill was the last installment in the federal government’s unprecedented (and unsustainable) two-year $6 trillion response to the worst global pandemic in over a century.

POLITICS AFFECT BUDGET PRIORITIES

President Biden and a Democrat-controlled Congress approved billions in new domestic spending for programs traditionally funded through the appropriations process.

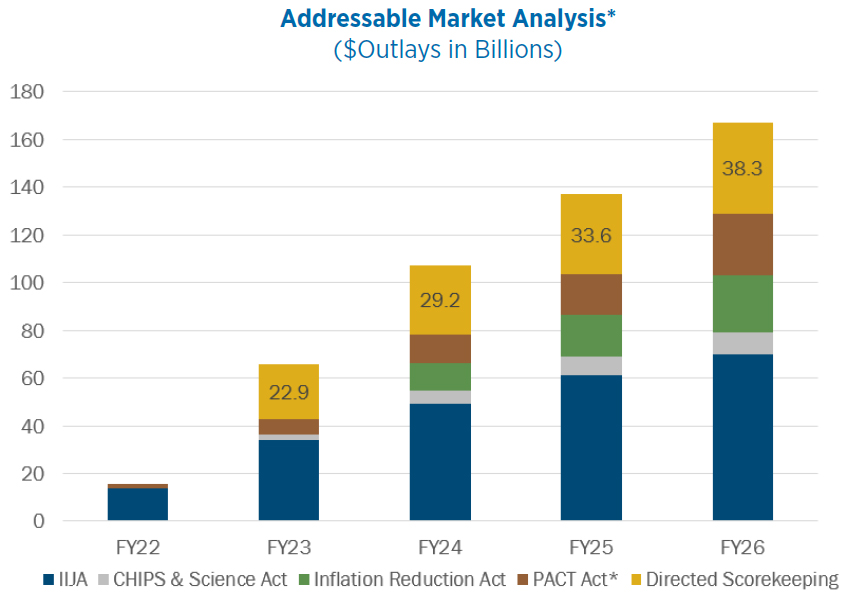

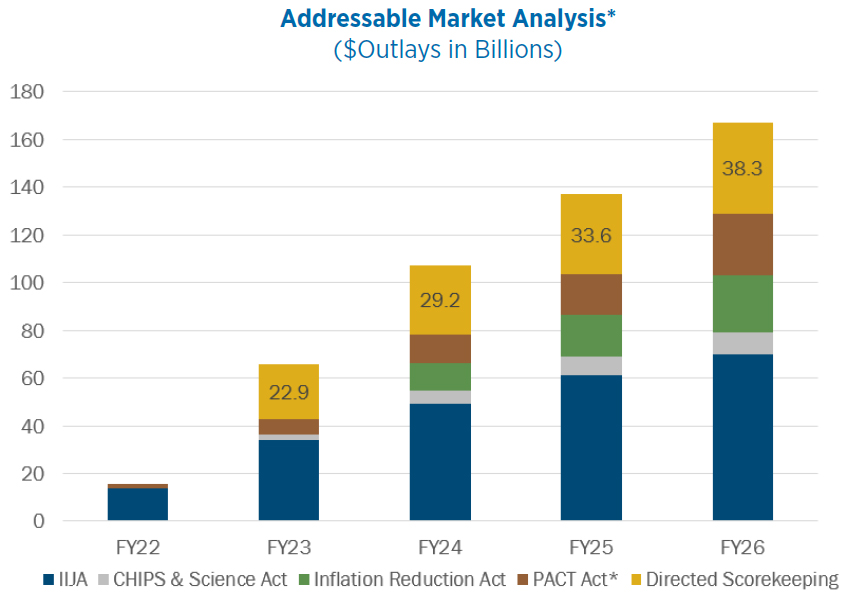

Together, four bills – IIJA ($228.1 billion), CHIPS ($25.1 billion), the Inflation Reduction Act ($52.4 billion), and PACT Act ($63.7 billion) – increase outlays for civilian programs traditionally funded through appropriations by an estimated $368.6 billion over the five-year FY22-6 period. Most of the increases in IIJA, CHIPS and the Inflation Reduction Act passes through to state and local governments, universities, and public-private partnerships in the form of grants. In addition, the PACT Act included a “directed scorekeeping” provision that reclassified base Veterans Affairs operating expenses—$127.8 billion in budget authority (BA) and $124 billion in outlays—as mandatory spending over the five-year FY22-6 period (see Chart I). All but one of the changes outlined in Chart I effectively increase the floor on non-defense spending totals over the next five years (FY23-7).

Chart I Source: CBO, FBIQ

A POST-ELECTION RECALIBRATION

Since budget caps were first created, Democrats and Republicans have argued over them, with Republicans prioritizing defense spending and Democrats prioritizing non-defense program spending. Over the past 12 years, whichever party was in the minority in Congress argued for parity between the defense and non-defense spending caps. Reaching that top-line agreement has been the central challenge in the first spending deal negotiated after the 2022 elections that gave control of the House to Republicans because parity ignores the new spending in Chart I.

SHIFTING BASELINE ASSUMPTIONS

The fact that two of the four major bills enacted in this Congress – IIJA and CHIPS – passed with bipartisan support protects them against future cuts. While the Inflation Reduction Act passed on party-line votes in the House and Senate, the new clean, green energy spending was fully offset by revenue increases and increased tax compliance from a boost in IRS enforcement. House Republicans will make noise about this in 2023, but they don’t have the votes to change it. PACT Act benefits for veterans exposed to burn pits has bipartisan support, but Republicans opposed the directed scorekeeping provision. Over 10 years, that provision effectively boosts non- defense appropriations baseline spending by $397 billion. In FY23, the directed scorekeeping provision shifts increases the non-defense spending baseline by $25.7 billion in BA and $22.9 billion. The fact that Republicans want to roll-back this provision explains the $25 billion non-defense spending dispute that held up negotiations over a FY23 spending deal until Thursday’s breakthrough.

[Negotiators have] reached a bipartisan, bicameral framework that should allow us to finish an omnibus appropriations bill that can pass the House and Senate and be signed into law by the president.

Senate Appropriations Chair Leahy (D-VT),

December 13

THE PATH FORWARD

Consistent with FBIQ’s forecast, both the House and Senate passed the FY23 National Defense Authorization Act (NDAA) with bipartisan veto-proof votes. The FY23 NDAA authorizes $857.9 billion for National Defense (050) and $816.7 billion for the Department of Defense (DOD) (051). Compared to FY22 appropriated levels, the NDAA calls for a 7.9 percent increase for the DOD. (See Goss article for details).

The House and Senate NDAA votes sent a clear market signal to leadership effectively raising the defense funding floor in the FY23 negotiations. On December 15, the House and Senate Appropriations Committee Chairs DeLauro (D-CT) and Leahy (D-VT) announced a framework for a year-end deal. With several details to be negotiated, the House voted 224-201 and the Senate 71-9 to pass a one-week continuing resolution (CR) giving negotiators time to complete their work. The CR vote provided Speaker Pelosi (D-CA) a good test for the votes needed to approve a FY23 spending deal. The 35-56 vote defeating a Lee (R-UT) amendment extending the CR to March 10 all but guarantees Senate support for a FY23 agreement.

FORECAST

>90% A final FY23 spending deal is enacted before the end of December.