UPDATE: On September 27, the Senate failed to invoke cloture on the House-passed CR/debt limit bill.

The two-track legislative strategy for implementing President Biden’s progressive “Build Back Better” agenda relies on budget reconciliation to bypass a Senate GOP filibuster. Passing sweeping legislation authorizing up to $3.5 trillion in new spending over united GOP opposition in both the House and Senate, with no Senate votes to spare and only a three-vote margin in the House, is a daunting challenge. Democrats’ decision not to address the debt limit in their budget blueprint has made implementing their agenda more difficult.

Treasury Secretary Yellen has urged Congress to extend the federal debt limit before the end of October. The stakes are high. A first-ever U.S. default would have devastating economic consequences. A downgrade of U.S. debt would impact financial markets, raise interest rates, and make America a more expensive place to live. President Biden, Speaker Pelosi (D-CA), and Senate Majority Leader Schumer (D-NY) know that the political fallout triggered by a default dramatically reduces their opportunity to implement the most sweeping progressive legislative agenda in over a generation.

The U.S. has never defaulted. Not once. Doing so would likely precipitate a historic financial crisis… compound the damage of the continuing public health emergency… trigger a spike in interest rates, a steep drop in stock prices and other financial turmoil. Our current economic recovery would reverse into recession, with billions of dollars and growth and millions of jobs lost.

Treasury Secretary Yellen,

September 19

By failing to authorize a debt limit extension in the budget resolution, Democrats probably lost the opportunity to add it to the current reconciliation bill.

Meanwhile Senate Republican Leader McConnell (R-KY) leads a concerted effort to convince House and Senate Republicans to oppose a debt limit extension. Senator Cruz (R-TX) also announced plans to filibuster any legislation extending the debt limit.

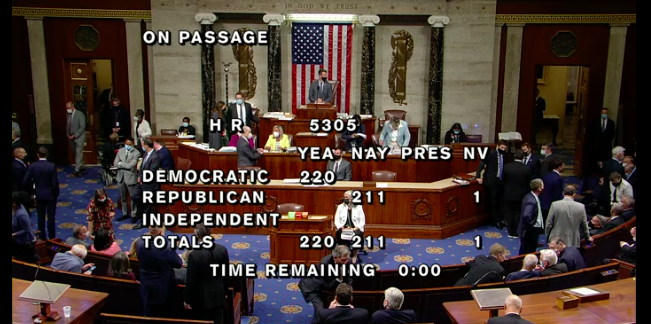

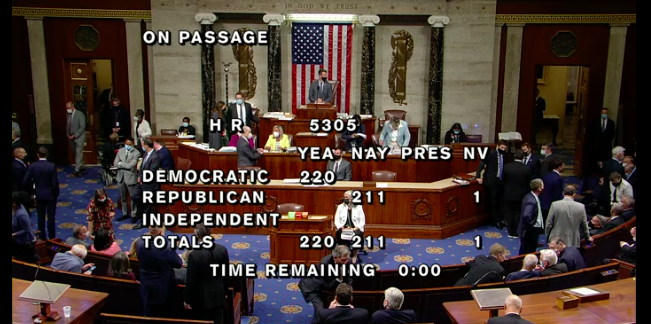

On September 21, Pelosi and Schumer called McConnell’s bluff. They introduced H.R. 5305, a continuing resolution (CR) that funds the government through December 3, 2021, provides $28.6 billion in disaster relief for hurricane and fire victims, and $6.6 billion in Afghan evacuee relief. The bill also includes a federal debt limit extension through December 16, 2022. The House passed H.R. 5305 on a party-line 220-211 vote.

This move is not a surprise. Linking a debt limit extension to “must-pass” measures with bipartisan support is a traditional tactic. Success of the Pelosi-Schumer strategy hinges on getting the 60 votes needed to invoke cloture and end Cruz’s filibuster. Pelosi, Schumer, and President Biden know that Schumer doesn’t have 60 votes.

If cloture fails, expect McConnell to offer an amendment striking the debt limit provision and to urge Senate passage of the amended CR to avoid an October 1 government shutdown.

With narrow House and Senate margins and looming deadlines, the stakes in this political game are high. On September 20, McConnell tweeted, “Democrats do not get to ram through radical, far-left policies on party-line votes, brag about how they are transforming the country, but then demand bipartisan cover for racking up historic debt. As I’ve said since July, they will need to address the debt limit themselves.”

Today, stripping the debt limit provision from the CR appears far more likely than cloture. Avoiding a shutdown requires enactment of a CR before October 1. Avoiding a default requires action before the end of October.

A handful of legislative and parliamentary options are available. All have pitfalls. With Democrats controlling the White House, the House and Senate, a shutdown or default would have devastating political consequences for President Biden, Pelosi, and Schumer.

Although prospects for a government shutdown and a default remain low, they have doubled over the past month with each of the “Big Four” Congressional leaders — Pelosi, Schumer, McConnell, and McCarthy (R-CA) — pursuing a debt limit brinksmanship strategy.

FORECAST

90%: Congress passes a Continuing Resolution with disaster assistance funding to avoid an October 1 government shutdown.

FORECAST

95%: Congress passes a debt limit extension avoiding an October default.