July 05, 2022

The Economy, Congress, and the Budget Outlook

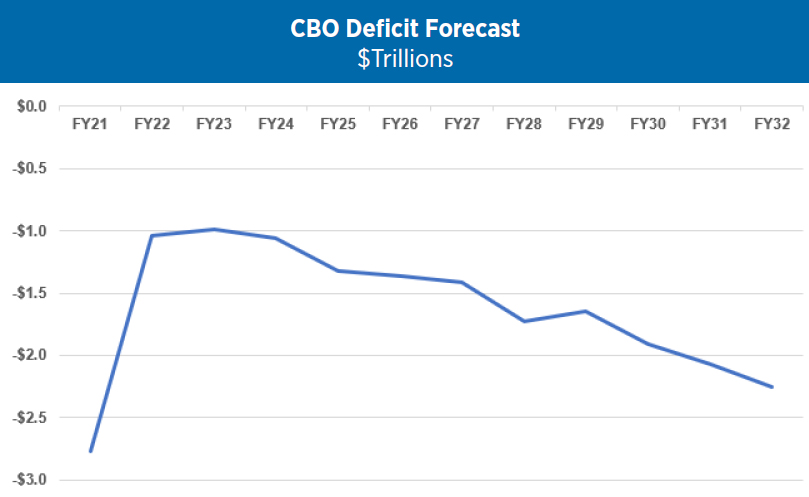

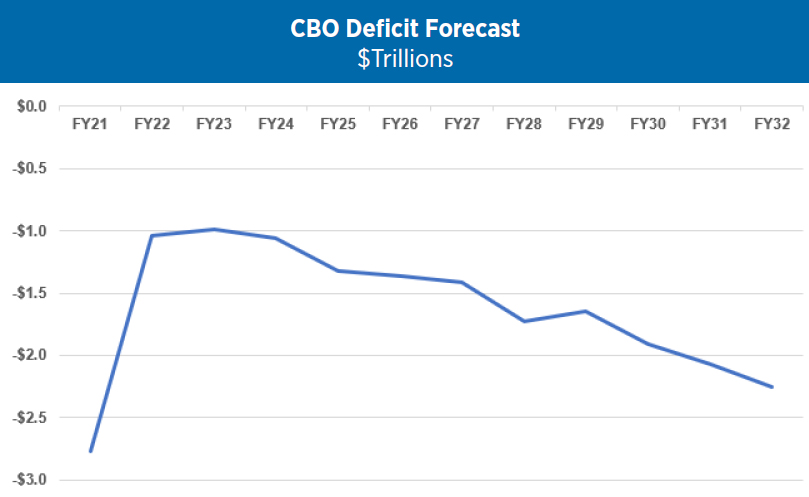

On May 25, 2022 the Congressional Budget Office (CBO) updated its budget forecast to show deficits increasing by $2.4 trillion over the next 10 years. In our view, this grim projection is probably low compared to what is likely to unfold due to a weakening economy in the short-term, and election-year actions by Congress and the President to increase annual deficits and debt.

Chart I. Source: Congressional Budget Office

Washington has increased spending and debt by eye-popping amounts over the past two years, in part as a result of pandemic response related measures, including the $1.9 trillion American Rescue Plan.

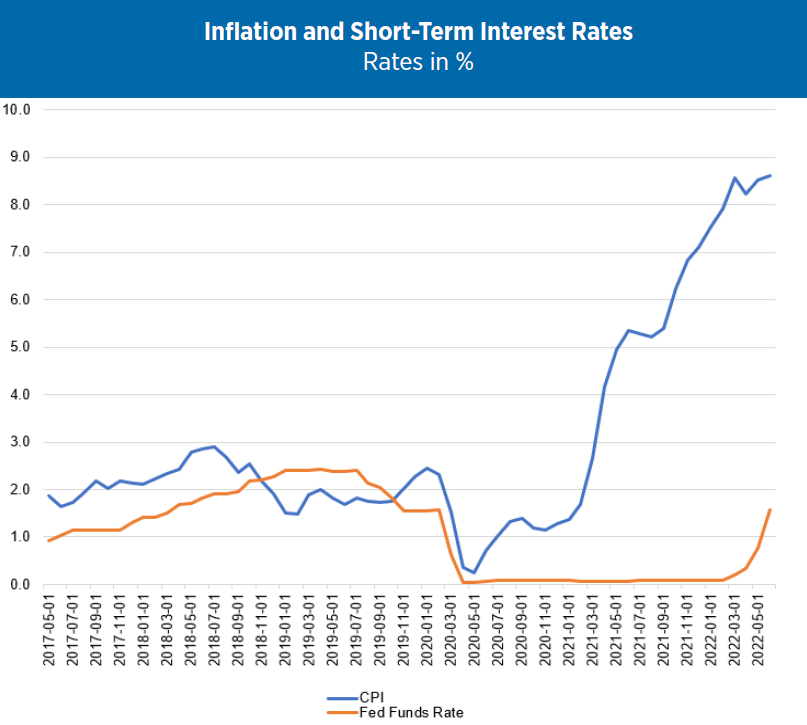

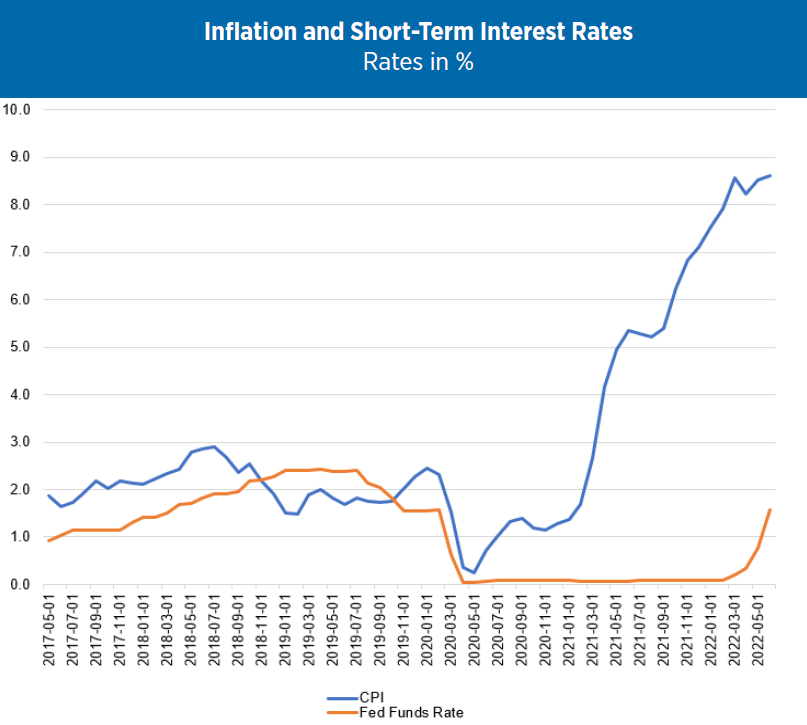

Until recently, with interest rates essentially at zero, debt-financed spending was costless. The Federal Reserve’s unprecedented monetary stimulus that drove interest rates down to essentially zero slashed Treasury borrowing costs. In 2020, federal debt increased 25% but debt servicing costs fell 8%. In response to rising inflation, the Fed has begun increasing interest rates and the result has been a surge in Treasury’s debt financing costs.

ECONOMIC HEADWINDS & THE BUDGET

Despite hopes that inflation was “transitory” or had peaked in April, the Bureau of Labor Statistics reported on June 10 that annualized inflation rose to 8.6% in May, the largest increase since December 1981. On June 15, the Federal Reserve increased the federal funds rate, the overnight lending rate between banks, by 0.75%, a departure from its planned 0.5% increase. Despite the large June increase in the federal funds rate and larger increases in other interest rates, the Fed appears to have more work to do to achieve its ultimate goal of bringing inflation down to 2%.

Chart 2. Source: Federal Reserve Bank of St. Louis.

In our view, CBO’s economic forecast was too optimistic. CBO has acknowledged its inflation forecast was too low. Former Treasury Secretary Lawrence Summers characterized CBO’s economic forecast as its “least plausible” over the past 40 years.

CBO’s economic forecast projects a strong economy with inflation quickly moderating and a relatively tame response in interest rates. They assume inflation will be relatively low this year (6.1%) and then rapidly declining to 3.1% in 2023. They project strong economic growth this year and next. In their forecast, the 10-year Treasury rate will average 2.4% this year (the 10-year Treasury broke through 2.4% at the beginning of April and now stands above 3%).

But a recession is not a certainty. Those making the case for a soft-landing point to the economy’s strong fundamentals: historically low unemployment, strong consumer balance sheets, and the easing of supply side disruptions as COVID fades.

The pessimistic case is that Washington overdid it with fiscal and monetary stimulus, got lulled into the view that rising inflation and interest rates were a thing of the past, and that the steps necessary to bring inflation under control will push the economy into a recession.

The White House response has evolved over the past year, from trumpeting the economy’s strengths and the “transitory” nature of inflation to now emphasizing that a recession is “not inevitable.” With the Federal budget highly sensitive to the economy, a significant slowdown or a recession would worsen the daunting budget outlook. The President’s FY23 Budget includes estimates on the sensitivity of the budget to changes in economic assumptions. According to OMB, a one percentage point reduction in real economic growth for one year increases the deficit by $1 trillion over 10 years.

BIPARTISAN LEGISLATION & THE DEFICIT

Although there are heightened concerns about deficits and debt, Congress is still pursuing legislation on a bipartisan basis that would add to the problem. CBO projections do not incorporate the cost of future legislation.

Congress is considering two bills with strong bipartisan support that would increase the deficit: Veterans legislation (Honoring our PACT Act) with a 10-year price tag of $200-$600 billion and international competitiveness legislation (the Senate version of this bill would increase the deficit by $53.5 billion over 10 years).

Much like Wile E. Coyote heading off a cliff, the US economy has plenty of momentum but rapidly

disappearing support. Falling back to earth will not be a pleasant experience.Bill Dudley, Former President of the New York Federal Reserve Bank and Vice Chairman of the Federal Open Market Committee,

June 22

While the House and Senate do not have an agreement on an appropriations framework yet, the Senate Armed Services Committee recently reported a defense authorization bill with strong bipartisan support that would increase defense spending by nearly 10%, which could culminate in bipartisan support for completing all the appropriations bills or a push from President Biden and Congressional Democrats for a similar increase for non-defense discretionary spending. In addition, there are variety of tax credits, deductions, and exclusions that have been routinely extended by Congress. None of these potential costs are included in CBO’s estimates.

DEFICITS, DEBT & THE CONGRESSIONAL RESPONSE

With strong bipartisan support, the Veterans bill and the international competitiveness legislation seem more than likely to become law this year. Appropriations will probably be delayed to a lame duck session but a strong bipartisan vote for a defense increase could build support for completing FY23 appropriations at higher levels.

A weaker economy, inflation, higher interest rates, and the enactment of deficit-spending legislation, darken the long-term budget outlook. Recent and current polling numbers strongly suggest that mid-term election voters give Republicans control of the House in 2023. After making rising deficits and debt an election-year issue, if Republicans control the House, they will be under pressure to demonstrate spending restraint.