President Biden signed the Fiscal Responsibility Act of 2023 (FRA) into law on June 3, 2023. In addition to suspending the debt limit through January 1, 2025, the law includes caps for two years on defense and non-defense appropriations, which by CBO estimates, accounted for nearly all of the law’s $1.5 trillion in deficit reduction. The law also provided an incentive to complete the appropriations process. If all 12 appropriations bills are not enacted into law by January 1, 2024 and a continuing resolution (CR) is enacted, discretionary spending would be reduced by 1% below the FY23 enacted level.

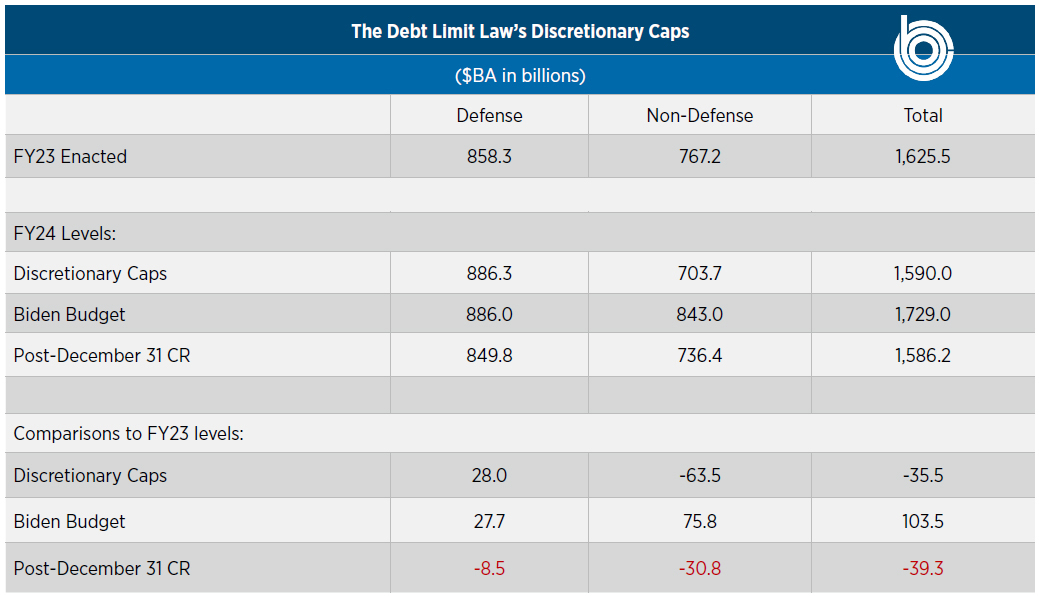

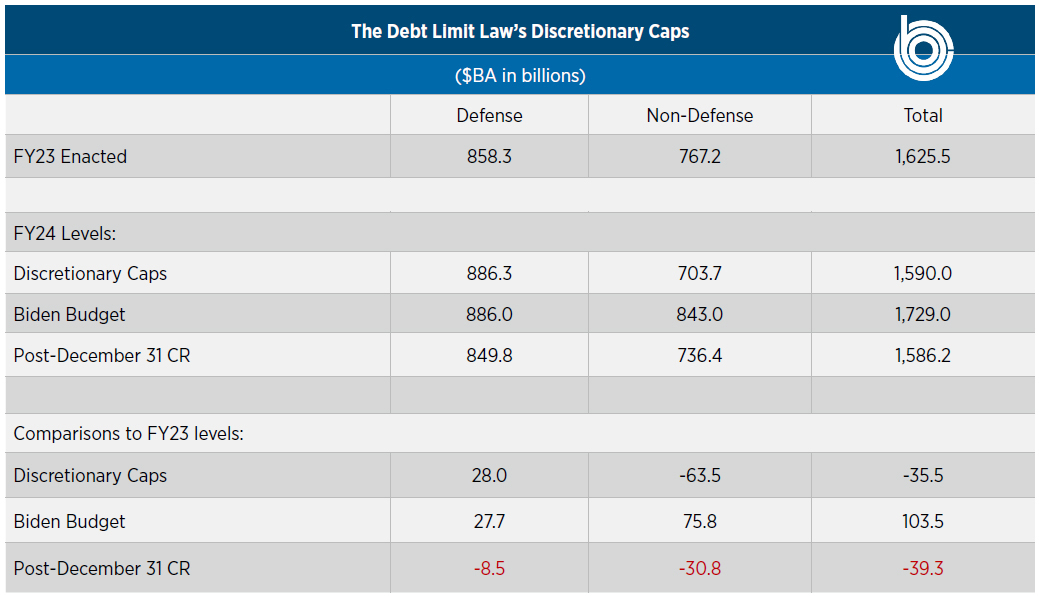

Chart I provides the FY23 enacted levels for base appropriations for defense and non-defense. Next, it compares the law’s FY24 caps on defense and non-defense appropriations, President Biden’s FY24 Budget, and the law’s reductions under a post- December 31 CR to FY23 enacted levels. Based on the cap levels set in the law, it appears to deliver on Republicans goal to achieve a big cut in non-defense discretionary spending. However, the Department of Defense budget, a Republican priority, is at risk under a CR that runs past December 31.

Chart I. Source: Congressional Budget Office

House Republicans claimed the agreement delivered on their goal—reducing non-defense spending to FY22 levels and the White House claimed it provided non-defense discretionary spending closer to a freeze at FY23 levels.

The White House claim of keeping spending close to FY23 levels is explained by a series of side agreements between the Speaker and the President that were not included in the law, which will have the effect of bringing non-defense discretionary spending close to FY23 levels. Unlike the text of law, the details of these side agreements have not been made public. Because they are not legally binding, they were not incorporated in CBO’s cost estimate of the legislation. However, in a White House briefing, OMB Director Young described them.

CROSSWALK FROM THE FY24 NON-DEFENSE CAP TO AGREEMENT LEVELS

In the past, Congress has circumvented spending caps by approving spending outside the discretionary totals. Examples include “emergency” spending designations for things like disaster relief that are cap-exempt. Appropriations measures also have included reductions in mandatory programs (known as “Changes in Mandatory Programs” or “CHIMPS”) that effectively offset additional spending.

While not part of the law, the White House and Speaker McCarthy (R-CA) agreed to a series of adjustments that cumulatively would raise FY24 non-defense discretionary spending to close to FY23 levels. A brief description of these adjustments follows.

- Mandatory Funding Boost for Both the White House and Republicans embraced full funding for Veterans. The law appropriated $20 billion for FY24 from the PACT Act’s Toxic Exposures Fund, a $15 billion increase over FY23 levels. Under the PACT Act this mandatory spending increase for expenditures traditionally funded under appropriations was not scored.

- Rescission of Unspent COVID FRA rescinds $27.8 billion of previously appropriated and unobligated COVID funds and appropriated $22 billion to a Department of Commerce Nonrecurring Expenses Fund. The agreement provides that $11 billion of this Fund’s $22 billion will be used in FY24 (the remaining $11 billion will be used in FY25) to increase non- defense spending.

- IRS Funding Rescission and The Inflation Reduction Act (IRA) provided $78.9 billion to the Internal Revenue Service (IRS) primarily for additional tax enforcement. The Republican-led House passed legislation to rescind the entire remaining balances of the IRA’s IRS funding. FRA rescinds $1.4 billion from IRS. In addition, the agreement allows an additional $10 billion from IRS rescission in FY24 (and another $10 billion in FY 25) to offset other non-defense discretionary spending. This allows Republicans to cut IRS enforcement funding and Democrats to use the balance to mitigate non-defense discretionary reductions while still preserving a sizeable increase in the IRS enforcement budget.

- Other Funding. The agreement provides for higher levels of reductions in mandatory spending to augment discretionary spending and for some currently base discretionary spending to be funded as an emergency and exempt from the caps.

Collectively, these changes if adopted shrink the advertised FY24 non-defense cap reduction outlined in FRA by over $50 billion. While not achieving the deep reductions House Republicans wanted, these higher levels would still be a remarkable change in non-defense appropriations, which have enjoyed large increases in recent years, including a 7% increase in FY23.