June 21, 2021

Biden Proposes Large IRS Investments

Like previous administrations, the Biden Administration recommends substantial investments in the Internal Revenue Service (IRS) to close the tax gap. The Treasury estimates that the tax gap — the difference between taxes owed and taxes paid — was about $600 billion in 2019 and could total $7 trillion over the next ten years.

Biden’s proposal focuses on enforcement, including increasing audit rates, to boost tax compliance among wealthy individuals and corporations, and it invests in activities that support enforcement, including operations and information technology. In addition to budget investments, the plan requires more comprehensive reporting from financial institutions, new regulations on paid tax preparers, and increased penalties on disreputable tax preparers.

With respect to IRS funding, the plan has two parts. The first component is a ten-year $72.5 billion stream of “mandatory” funding, which is funding approved outside of the congressional appropriations process (such as through a budget reconciliation bill). Creating new mandatory funding circumvents spending limits placed on appropriations bills.

The second component is a ten-year $6.7 billion “program integrity” allocation given to the appropriations committees, which allows the committees to fund IRS enforcement and operations above their base funding levels. Program integrity adjustments exist for a few other federal programs that bring additional money to the Treasury by policing waste and fraud. Program integrity spending triggers an increase to discretionary appropriations limits, providing another way to get around spending constraints.

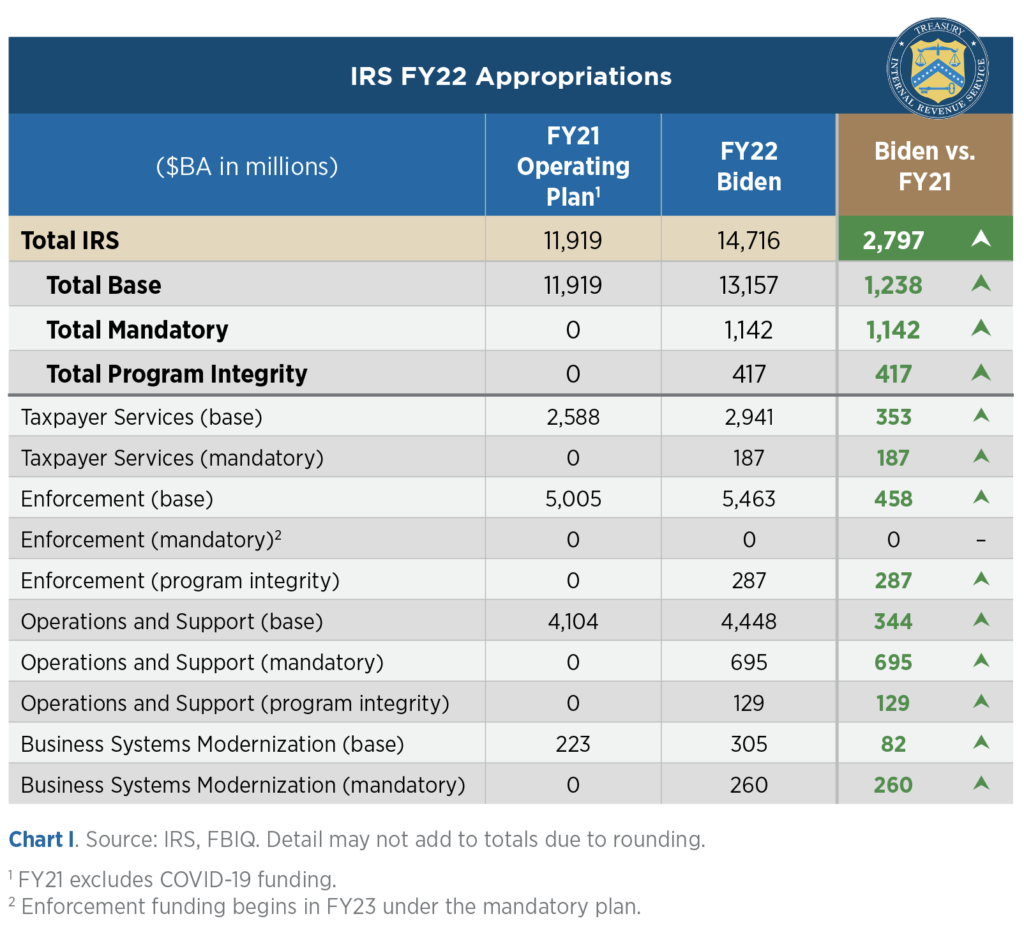

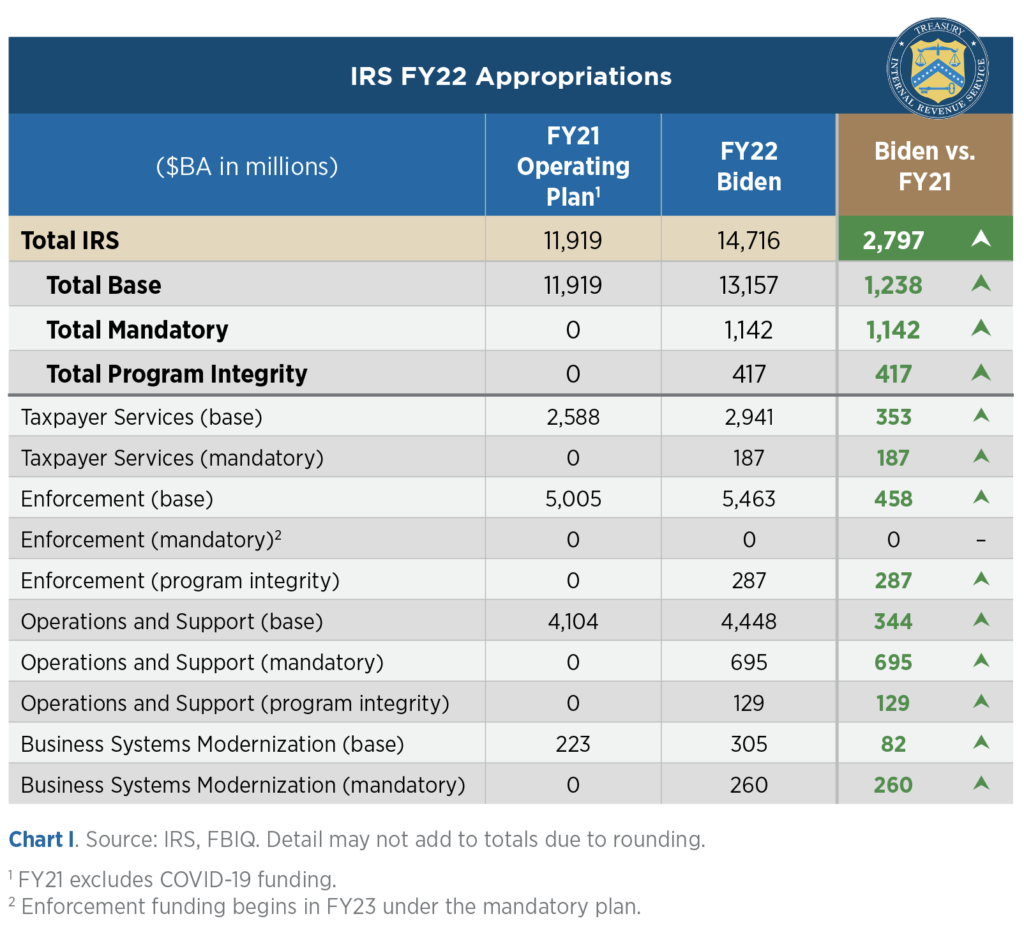

A distinction between the mandatory funding plan and the program integrity plan is the scope of activities funded by each. Both fund the IRS Enforcement account (under the mandatory plan, Enforcement funding begins in FY23) and the Operations Support account. The mandatory plan goes further by also funding the Taxpayer Services and Business Systems Modernization (BSM) accounts. Over ten years, BSM would receive more than $4 billion in additional funding, starting with $260 million in FY22 over and above Biden’s base appropriation request of $305 million. Chart I shows the IRS FY22 budget request for IRS accounts compared to the FY21 funding level.

There is bipartisan congressional consensus that the IRS needs to modernize its IT systems. For years, Congress has funded the Customer Account Date Engine 2 (CADE 2), which replaces the legacy Individual Master File, IRS’s core tax processing system initially developed in the 1960s. Budget constraints are a factor slowing the development of this and other IT systems. According to IRS Commissioner Rettig, the agency has received only 55% of the appropriations it has requested for its Integrated Modernization Plan. While Congress supports modernization, technology programs often are short-funded and postponed when discretionary appropriations limits are tight. Linking technology modernization with an enforcement program that brings in additional revenue may help address this issue — if Congress is willing to approve a plan that circumvents spending limits.

Modernized technology will allow the IRS to make data more easily available for service and enforcement purposes and to move toward near real-time tax processing.

The American Families Plan Tax Compliance Agenda, May 2021

Revenue Windfall?

There is general agreement that increased IRS tax enforcement funding will generate additional revenue but a great deal of debate on the amount of revenue that will be raised and how quickly it can be collected. While there is bipartisan support for additional tax enforcement, there are other complications that may limit how much revenue these measures will produce and their inclusion in legislation that becomes law.

The Treasury Department estimates that its tax compliance initiative will generate roughly $776 billion in additional revenue over the next decade, with a $316 billion revenue gain from additional funding for tax enforcement and $460 billion in higher revenues from additional reporting requirements and new penalties. After netting out the cost of additional IRS investments, the ten-year deficit reduction is estimated to be nearly $700 billion.

For the additional $79.2 billion in IRS enforcement funding, Treasury estimates it will generate $316.2 billion in additional revenue over 10 years, a 4 to 1 return. Breaking this down, Treasury estimates that the mandatory funding will produce a 3.7 to 1 return and the program integrity component, which is focused solely on enforcement, generating a 7.5 to 1 return.

Congress uses Congressional Budget Office (CBO) estimates, which are more conservative than Treasury’s. While CBO has not yet completed its estimate of the President’s FY22 budget, they estimated last year that a $20 billion increase in the IRS enforcement budget over ten years would generate $61 billion in additional revenues for a 3 to 1 return, less than half of what Treasury estimates. Since the initial IRS enforcement investments tend to collect low-hanging fruit, more funding brings less return. CBO estimates that the return shrinks to 2.6 to 1 for a $40 billion IRS funding increase.

In addition to CBO estimating a smaller revenue gain, congressional budget scoring rules do not allow revenue gains from increases in administrative funding (e.g., hiring more auditors) to be credited to either appropriations or mandatory spending legislation. CBO will develop an estimate of the revenue gain but will not credit the gain to the legislation providing the funding.

In past budget enforcement laws that established discretionary spending caps, Congress provided program integrity funding for the Social Security Administration and the Department of Health and Human Services and touted CBO’s estimated budget savings from these initiatives. Although spending legislation could not get direct credit for the savings, the program integrity investments were effectively exempted from the spending caps. In the absence of spending caps in law, Congress could provide a reserve fund in a budget resolution that would have a similar effect.

Despite these hurdles, Republicans have been cautiously supportive of additional IRS enforcement funding. As a result, an IRS program integrity proposal is a possible candidate to use as an offset for a bipartisan infrastructure bill or a bipartisan budget agreement to set the topline for discretionary spending in FY22. Republicans have thus far rejected tax increases to offset the President’s infrastructure plan. Pointing to the revenue increase from higher IRS enforcement funding, something that President Trump included in past budgets, allows Congress to tout an offset without increasing taxes.

If Democratic leaders decide to pursue budget reconciliation to implement the President’s American Jobs or American Families Plan, the other option would be to include mandatory funding for IRS enforcement activities in reconciliation. They would not get budget scoring credit for the additional revenue from these activities, but they could still point to a CBO estimate of increased revenue. As with all contentious legislation, politics enters the equation. If Republicans attack a reconciliation bill for “raising taxes” and increasing funding for IRS audits, those partisan attacks could weaken Democratic support.

A ten-year, $79.2 billion IRS enforcement investment would be a major windfall for an agency that received a total FY21 appropriation of $11.9 billion. Even though there’s bipartisan support for closing the tax gap, Congress may be reluctant to provide such a large increase. Congress may listen to former IRS Commissioner Koskinen, who was quoted in an April 27 New York Times article as saying: “I’m not sure you’d be able to efficiently use that much money.” He suggested that a $25 billion increase over ten years would be more realistic. A smaller increase might come at the expense of IT modernization as Congress tries to maximize its return on investment by first increasing the IRS workforce.

FORECAST

75% | Congress approves a scaled-back IRS enforcement initiative as part of a broad infrastructure or reconciliation bill or a budget agreement