All the Democratic Presidential candidates have made raising taxes and revenues, particularly on higher income taxpayers, a key campaign plank. Unless Democrats regain control of the White House and the Senate, tax rate increases will encounter stiff resistance, particularly in the Senate.

Changes in tax law will depend on the outcome of the election and the dynamics that follow. Putting aside election outcome predictions, the focus here is on the tax gap and proposals to raise revenue by closing the gap. Unlike raising tax rates, these proposals enjoy support from Democrats and the Trump Administration.

The Tax Gap

The tax gap is the amount that total revenue collections fall short of total tax liabilities. The Internal Revenue Service (IRS) estimates the tax gap averaged $441 billion annually for 2011-2013. If late payments and revenue from enforcement actions are taken into account, IRS estimates a net tax gap of $381 billion. With an estimated total tax liability of $2.7 trillion, the compliance rate for net taxes is 85.8%.

The IRS illustrates the tax gap with a map. To simplify, most of the tax gap is due to under-reporting ($352 billion or 80%) and most of the gap is attributed to individual tax returns ($314 billion or 71%). According to the IRS, compliance is highest when subject to information reporting and even higher when also subject to withholding.

Closing the Gap

Leading Democratic candidates, including Warren, Sanders, Bloomberg, Klobuchar, and Buttigieg, have highlighted greater IRS enforcement to collect revenues from the wealthy. Last March, six Senators, including Sanders (I-VT) and Warren (D-MA), wrote the IRS urging greater tax enforcement. Former Treasury Secretary Larry Summers has estimated that increasing the IRS budget to previous peak levels, investing in information technology, and greater information reporting and audits could generate $1 trillion, more revenue than increasing the top marginal tax rate to 70%. Moreover, Summers points out that the tax gap is primarily due to high income taxpayers and enforcement efforts should be focused on them. And, he notes that closing the tax gap generates revenue without raising tax rates.

Democrats are not alone in advocating greater IRS enforcement. The President’s FY21 budget proposes an additional $400 million in IRS funding through a cap adjustment. The Administration estimates that a $15 billion increase over 10 years in the IRS enforcement budget would generate about $79 billion in revenues, and the Administration notes that this estimate does not include the revenue that would be gained due to the deterrent effect of stronger enforcement. CBO shows a smaller, but significant, return of over 2 to 1 from higher IRS enforcement spending. And, the Government Accountability Office (GAO) has listed tax enforcement as part of its high-risk series each year for the past thirty years and also reported on the risks associated with IRS IT systems.

The IRS invests less than a quarter as much in information technology as major banks and still relies on systems from the 1960s. Pilot projects suggest payoff rates on strategic IT investments could approach 50:1.

Former Treasury Secretary Summers, November 17th

Two Blows to the IRS Budget

The first blow was delivered by the Budget Control Act of 2011 (BCA). As with all non-defense agencies funded with discretionary appropriations, the BCA triggered a sequester on March 1st, 2013 that cut non-defense discretionary accounts by 5%.

While the IRS is not a popular agency, it had earned a reputation for being non-partisan. That changed in 2013 when House Republicans investigated IRS’s review process for tax-exempt organization applications. While the Obama Administration concluded there was no criminal activity, the Treasury Inspector General for Tax Administration reported to Congress that the IRS inappropriately targeted Tea Party and other conservative groups. That same year, Congress learned the IRS had given bonuses to Lois Lerner, the IRS official overseeing tax exempt organizations. That led to the second blow to the IRS budget, when the Republican-led House Appropriations Committee approved a FY14 appropriations bill that cut the IRS by 24% below the FY13 CR funding level. Most of that reduction was restored in the final bill, but the IRS was still cut by $271 million (2.4%) below the previous year’s level.

Next, an attempt by conservative House Republicans to impeach IRS Commissioner Koskinen was blocked by a bipartisan vote. Republican hostility toward the IRS has diminished, particularly with a Republican in the White House, a Treasury Secretary respected by Democrats, and a less controversial IRS Commissioner.

As a result, the IRS budget has fared better in recent years. With about two-thirds of IRS’s budget devoted to employee compensation and Congress granting pay raises in recent years, those budget increases have been more than absorbed by personnel costs. The reduction in the funding has led to a dramatic decline across the agency, including for IT, operations, customer service, and enforcement. Although the IRS saw a slight uptick in its workforce in FY19, it was still 27.5% below FY10 levels.

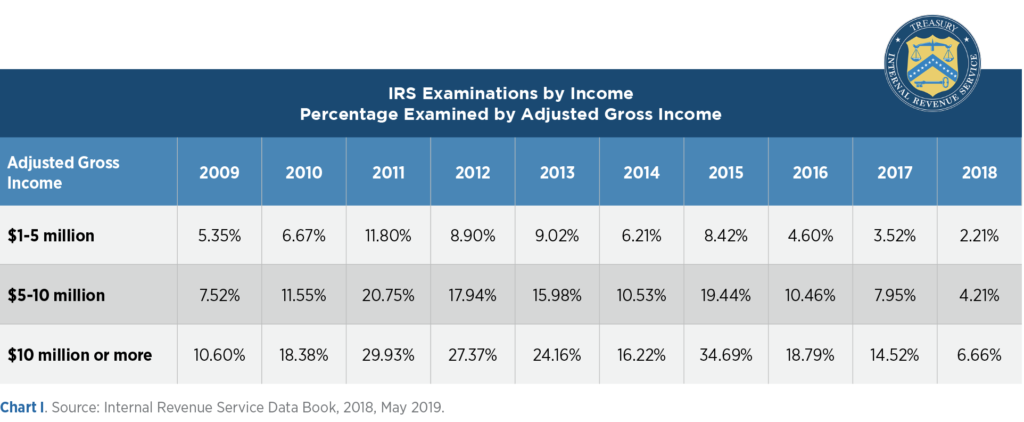

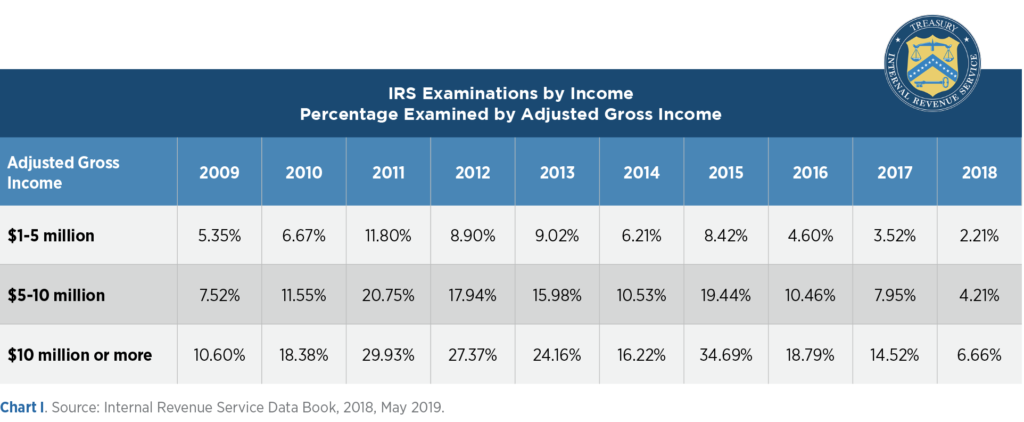

With a declining budget and workforce, IRS’s examinations or audits also have plummeted since FY10, dropping from 1.1% of all returns being examined to 0.45% in FY19. Generally, the IRS focuses its enforcement efforts on those that receive refundable credits where there are high improper payment rates and higher income levels. The audit rate in FY18 for those with adjusted gross income (AGI) from $0 to $1 million ranged from a low of 0.44% of returns with AGI between $100,000 and $200,000 to a high of 2.04% for those filers with no AGI. Chart I shows the decline in audit rates at income levels above $1 million.

Closing the tax gap is much more than a personnel issue. The agency has struggled to modernize an antiquated IT system. Also, the agency faces several priorities that compete for scarce budget resources. Last year the Congress passed the Taxpayer First Act, the first IRS reform in over 20 years, that calls on the IRS to improve taxpayer services, modernize operations and technology, and ensure better cybersecurity and identity protection.

After the election, the President and Congress will face $1 trillion deficits, no agreement on a topline for FY22 appropriations, and a federal debt limit that expires on August 1st, 2021. No one knows yet how these issues will be resolved, but we expect a growing IRS budget and enforcement effort to be part of the equation. It provides a relatively easy offset that increases collections from higher-income taxpayers without changing tax rates.

Why is it important to audit high wealth taxpayers?

— Ways and Means Chairman Neal (D-MA)“… As Willie Sutton said, that is where the money is…”

— Treasury IG for Tax Administration GeorgeHouse Ways and Means Committee hearing, May 9, 2019

Austin Smythe is the former Policy Director for Speaker Paul Ryan and former Policy Director for the House Ways and Means Committee.