Enactment of the Fiscal Responsibility Act and its extension of the debt limit to January 1, 2025 shifted the focus of the budget discussion in Washington from debt and default to spending. Two recent announcements reversed that trend. On July 31, the Treasury Department announced it would borrow $1 trillion in the July-September quarter, a $274 billion (37%) increase from its May 2023 estimate. The next day Fitch Ratings downgraded Treasury securities from AAA to AA+ rating.

I strongly disagree with Fitch Ratings’ decision. The change by Fitch Ratings announced today is arbitrary and based on outdated data.

Treasury Secretary Yellen,

August 1, 2023

While there were conflicting conclusions on the Fitch downgrade, Treasury securities remain the safest financial security in the world and the U.S. dollar remains the global reserve currency. The U.S. has inherent strengths that are unmatched, but no nation can take those advantages for granted. While not an immediate risk, over the longer-term, the huge surge of Federal debt poses a growing risk to U.S. credit ratings, the strength of the dollar, and economic growth prospects.

This is a wake up call to get our fiscal house in order before it’s too late.

House Budget Committee Chairman Arrington (R-TX),

August 1, 2023

UNSUSTAINABLE FEDERAL DEBT GROWTH

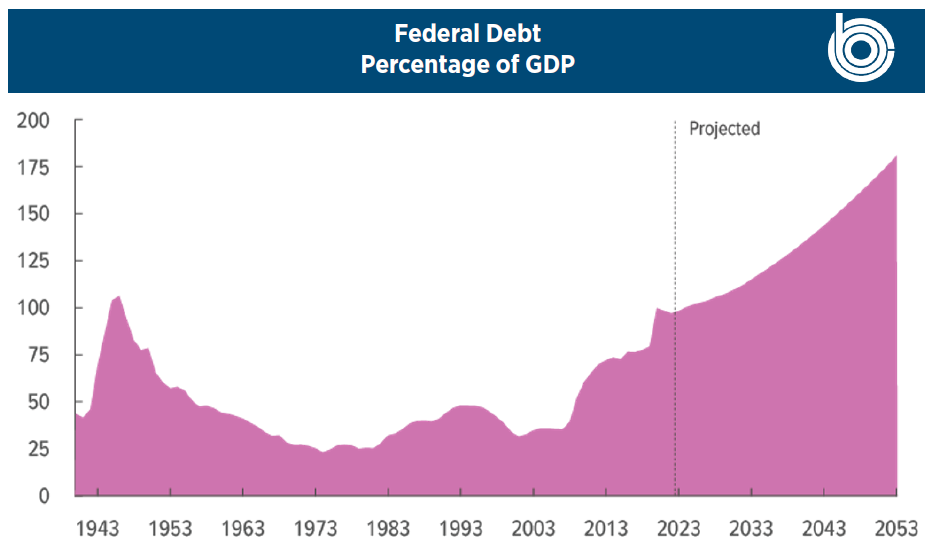

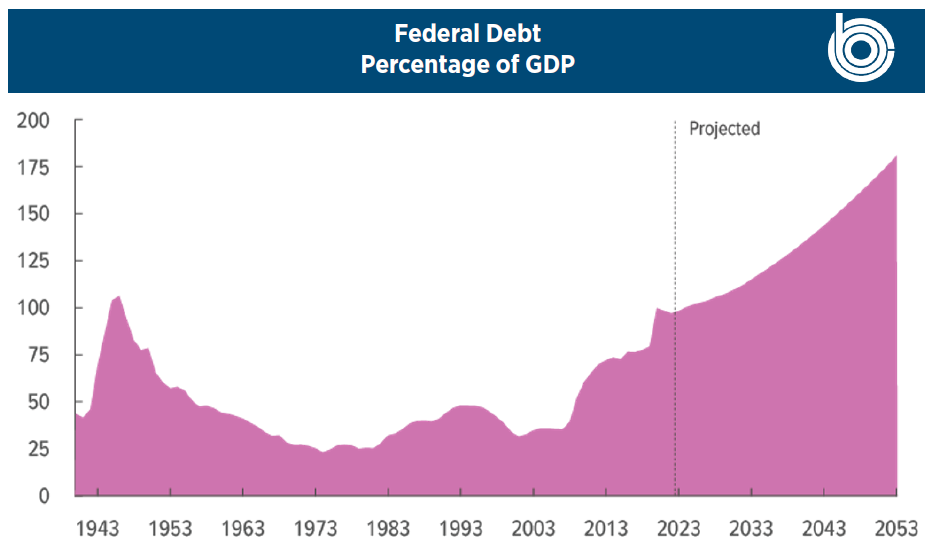

If the pandemic and the unprecedented monetary and fiscal response had led to a one-time surge in the debt followed by an immediate and steep decline as usually has occurred in the country’s past, the U.S. fiscal position would be much more manageable. But as shown in Chart I, Congressional Budget Office (CBO) projections demonstrate that under current law, the federal debt trajectory is unsustainable. Debt growth is driven by mandatory spending and debt service costs that are increasing faster than the economy.

…high and rising debt would, among other things, slow economic growth, drive up interest payments to foreign holders of U.S. debt, elevate the risk of a fiscal crisis, increase the likelihood of other adverse effects that could occur more gradually, and make the nation’s fiscal position more vulnerable to an increase in interest rates.”

Congressional Budget Office, The 2023 Long-Term Budget Outlook,

June 2023

CBO projects that in six years debt will exceed the historical record of 106% of gross domestic product (GDP) hit following World War II, and continue a steady rise to 181% of GDP by 2053. In a separate report, CBO analyzed eight alternative scenarios, one of which assumed interest rates rose by 5 basis points each year compared to its base case. In that scenario, the average interest rate for federal debt rises from 4% in their base case to 5.8% by 2053. The impact on the debt is dramatic, rising from 181% of GDP to 231% of GDP by 2053.

Chart I. Source: Congressional Budget Office, 2023 Long Term Budget Outlook, June 2023.

The risk in this analysis appears to be on the downside. CBO’s budget projections are based on current law and do not include likely policy extensions and expansions that would increase debt. Also, FBIQ is concerned that CBO’s long-term interest rate assumptions are too optimistic.

TROUBLING RECENT BUDGET DATA

CBO’s current budget projections are based on its December 2022 economic forecast. CBO, along with most other economists, projected the U.S. economy would slow considerably in 2023 and then rebound in 2024.

While the economy’s performance outpaced CBO’s 2023 projections, its budget impact has not. CBO projected real gross domestic product (GDP) growth of 0.1% in 2023. For the first two quarters of 2023, the Bureau of Economic Analysis reported real GDP growth of 2.0% and 2.4%, respectively. CBO projected the unemployment rate would rise to 5.1% in 2023; the Bureau of Labor Statistics reported an unemployment rate of 3.5% for July. Unemployment has not exceeded 3.7% this year.

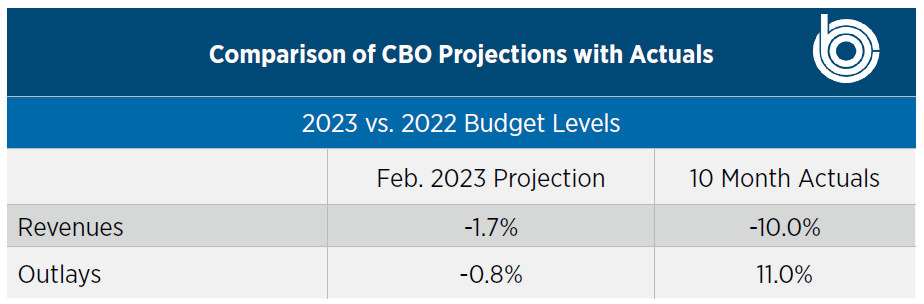

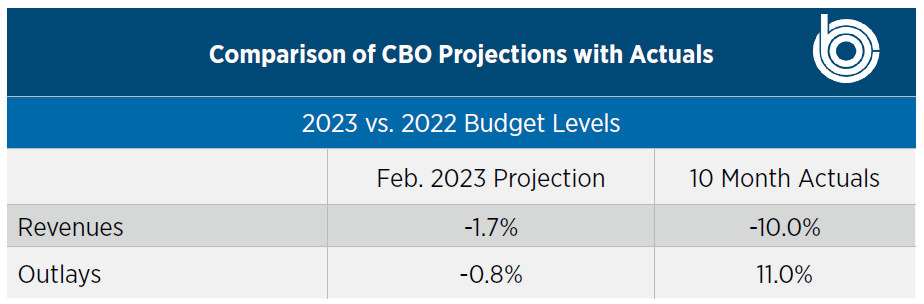

Usually, a stronger economy translates into higher tax collections, lower spending, and lower deficits and debt as a share of GDP. Chart II compares the percentage change in spending (outlays) and revenues relative to the previous year that CBO projected for 2023 compared with actual budget results through the first 10 months of 2023. While the first 10 months don’t tell the whole story, receipts are trending well below and outlays (spending) well above CBO’s projections for the year. Lower revenues and higher outlays have translated into higher deficits and debt. Based on these actuals, CBO currently estimates the deficit will be $1.7 trillion in 2023, nearly $300 billion higher in FY23 than they projected last February. CBO projected the debt would rise to $25.716 trillion by the end of the fiscal year (September 30). Debt eclipsed that level on July 25, 2023.

Chart II. Source: Congressional Budget Office.

Although the long-term fiscal outlook is troubling, the U.S. does not face an immediate debt problem from either a financial or political standpoint. The Treasury debt market appears to be liquid and vibrant, enjoying a status unmatched in the world. On the political side, Congress will not need to address the debt limit until after the Presidential election next year and will have some time in 2025 due to Treasury’s extraordinary measures before it faces a potential default.