By mid-August, we expect Congress to enact another major COVID-19 relief package that increases the price tag on the unprecedented federal response to approximately $5 trillion, roughly one-fourth of 2019’s $21.43 trillion U.S. Gross Domestic Product.

Why mid-August? State reopening actions that failed to comply with CDC guidelines extended the first wave of the virus in the U.S. and increased caseloads. Outbreaks in Arizona, Florida, Texas, and other states have strained the capacity of healthcare systems. Prolonged test result delays limit the effectiveness of contact tracing, keep healthy workers from returning to work, reduce confidence that schools and businesses can safely reopen, and jeopardize the larger-than-expected 4.8 million June increase in nonfarm payroll.

Those factors increase both the urgency and the likely price tag on the next round of federal relief for state and local government. On April 22nd, a $500 billion federal aid request from the National Governors Association represented the likely ceiling on that element of the next relief bill. By the end of June, $500 billion became the minimum required to fill the state and local government revenue gap and avoid millions of additional state and local government lay-offs beginning by September. Aid requests from state and local government officials now top $1 trillion.

The spread of the virus complicates school reopening decisions across the country. We expect the next bill to include additional funding dedicated to education primarily to stabilize public education funding and avoid teacher lay-offs with incentives to subsidize end-point devices, address connectivity gaps, and support teacher distance learning training.

FORECAST

90% The next federal relief bill includes at least $100 billion for public education.

We also expect the growing health crisis to increase federal health sector spending beyond the $209 billion in the House-passed Heroes Act with the bulk of that funding focused on the healthcare Provider Relief Fund as well as testing and contact tracing.

As it did in negotiations over Phases 1-3.5 of the federal response, the Trump Administration has prioritized stimulating the economy. Expect this round to include safe-harbor protection for schools, hospitals, and businesses to facilitate reopening, incentives for those on unemployment to return to work, and more targeted stimulus payments focused on workers making $40,000 per year or less. Another goal for Senate Majority Leader McConnell (R-KY) is to make this next deal the last federal COVID-19 relief package before the elections. Achieving that objective should increase the cost of the next deal.

There’s going to be a heavy emphasis in the bill I’m going to unfold next week on education. I know it will be costly.

Senate Majority Leader McConnell, (R-KY) July 15th

After a 6-week stalemate, prospects for a deal increased in July. On the same day (July 9th) that Speaker Pelosi (D-CA) acknowledged discussions with the Administration and Senate Republicans had increased “because they know there has to be a bill,” Secretary Mnuchin, the Administration’s lead negotiator on Phases 1-3.5, announced his intention to begin bipartisan negotiations this week with the goal of finalizing and adopting the next bill “between the 20th and the end of the month.”

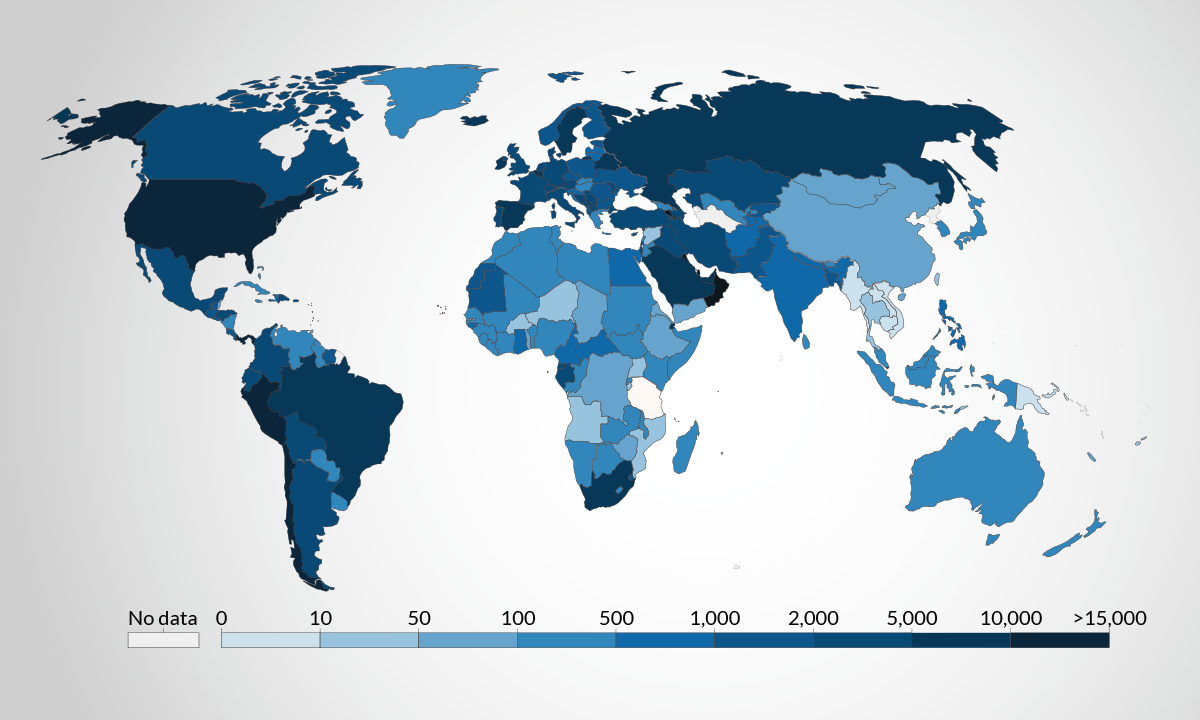

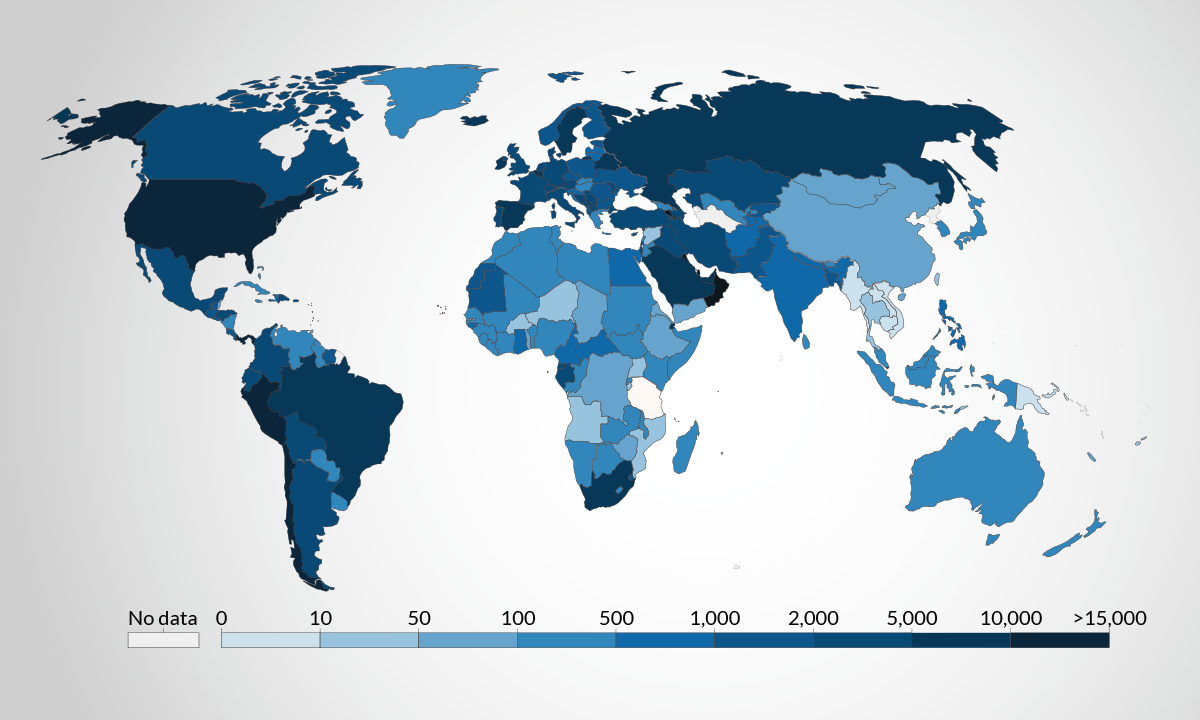

That timetable may not hold, but both sides have strong political incentives to finalize a deal that avoids additional lay-offs and delivers tangible results to key constituencies before their August presidential conventions. Increasing caseloads, particularly those in southern states, have already increased the price tag on that bill with new cases exceeding the 60,000 per day mark for the first time earlier this month. Dr. Fauci warned that unless CDC guidelines are followed, new cases per day could reach the 100,000 mark. If that occurs, expect Congressional Democrats to push for another relief package.

For federal agencies, the pandemic has impacted spending patterns and priorities and accelerated several trends in the private sector and across government. For example, the dramatic shift to telework at most federal agencies slowed the contract award process from mid-February through mid-April backloading the FY20 procurement approval process, particularly for IT, into the 4th quarter (July-September). It also changed agency IT spending priorities. Demand for endpoint devices for remote federal workers spiked in March and April.

As Dale Oak predicted in May, the House Appropriations Committee increased emergency spending for VA and other agencies to avoid program disruptions in FY21 when the current statutory spending caps limit spending growth to 0.8%. We expect most agencies to operate through most of the first quarter of FY21 (Oct-Dec 2020) under a continuing resolution designed to protect COVID-19 related activities from CR funding restrictions.

In September, expect public sector priorities to begin shifting from managing the immediate “ramp” and “recover” phases of the pandemic response to adjusting to a “new normal” that likely involves additional COVID-19 outbreaks over the next 18 months. In the next 90 days, competing blueprints for a post-election “rebuild” initiative will emerge.